📖 Cryptocurrencies and Blockchain: Essential Concepts for Reading Comprehension

Cryptocurrencies and blockchain technology represent a transformative shift in how digital transactions and data are managed. Cryptocurrencies, like Bitcoin and Ethereum, operate as decentralized digital currencies, while blockchain serves as the underlying technology that ensures transparency, security, and decentralization. RC passages on cryptocurrencies and blockchain often explore their implications for finance, technology, and society. Understanding these concepts helps readers critically analyze their advantages, challenges, and potential future developments.

🔑 Key Concepts

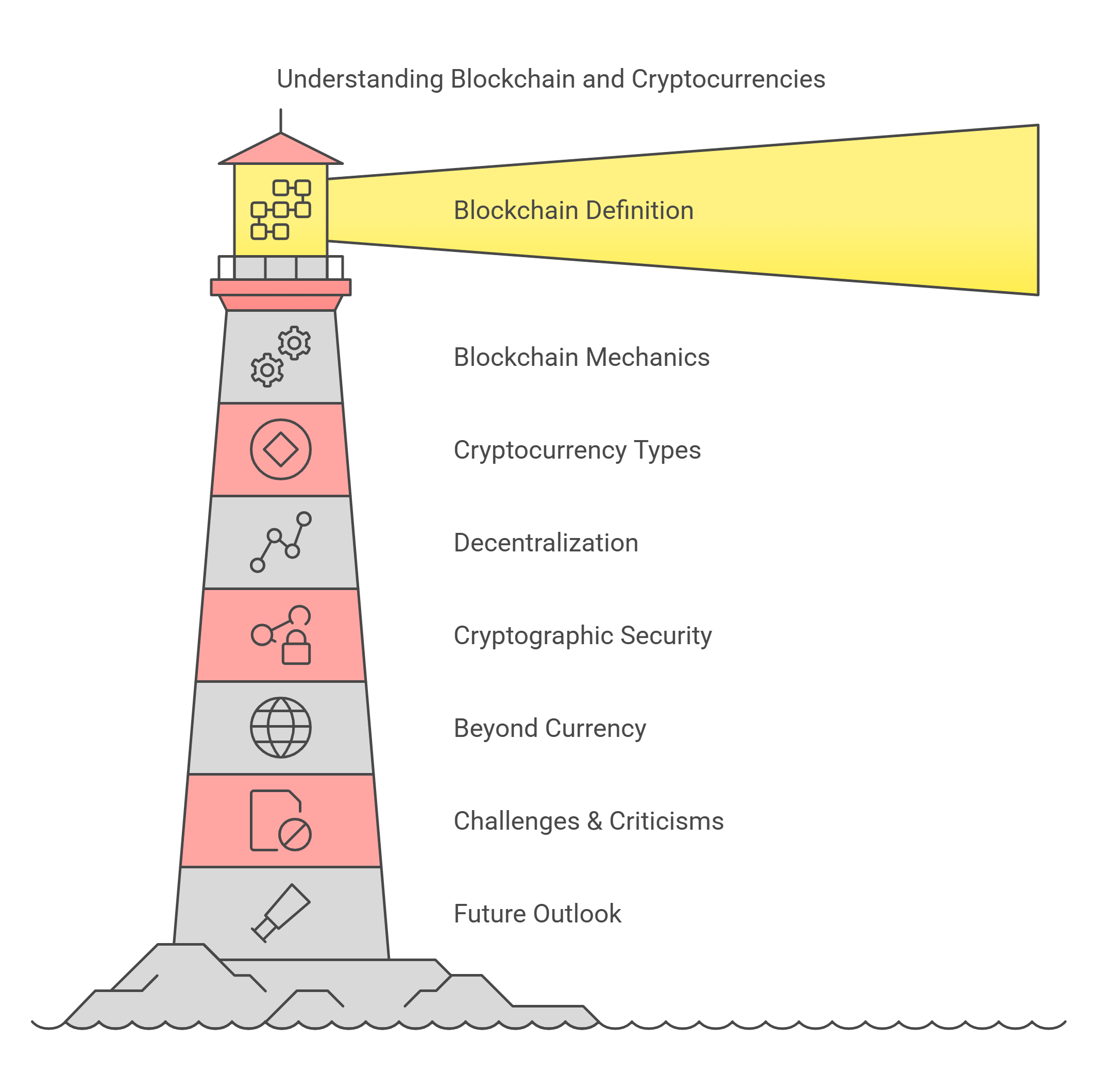

This guide will explore the following essential cryptocurrencies and blockchain concepts:

- Definition of Blockchain and Cryptocurrencies

- How Blockchain Technology Works

- Types of Cryptocurrencies

- Decentralization in Blockchain

- Cryptographic Security in Blockchain

- Applications of Blockchain Beyond Cryptocurrencies

- Challenges and Criticisms of Cryptocurrencies

- Regulation and Legal Frameworks

- Environmental Impact of Blockchain

- The Future of Blockchain and Cryptocurrencies

🔍 Detailed Explanations

1. Definition of Blockchain and Cryptocurrencies

Blockchain is a distributed ledger technology that records transactions across a network of computers. Cryptocurrencies are digital assets that use blockchain technology to operate securely and independently of central authorities.

- Blockchain: Ensures transparency and immutability by storing data in “blocks” linked in chronological order.

- Cryptocurrencies: Act as digital currencies or tokens exchanged on these blockchain networks.

- Example: Bitcoin, created in 2009, was the first cryptocurrency to leverage blockchain technology.

Explained Simply: Blockchain is like a digital notebook shared across a group, and cryptocurrencies are like tokens used within that notebook.

2. How Blockchain Technology Works

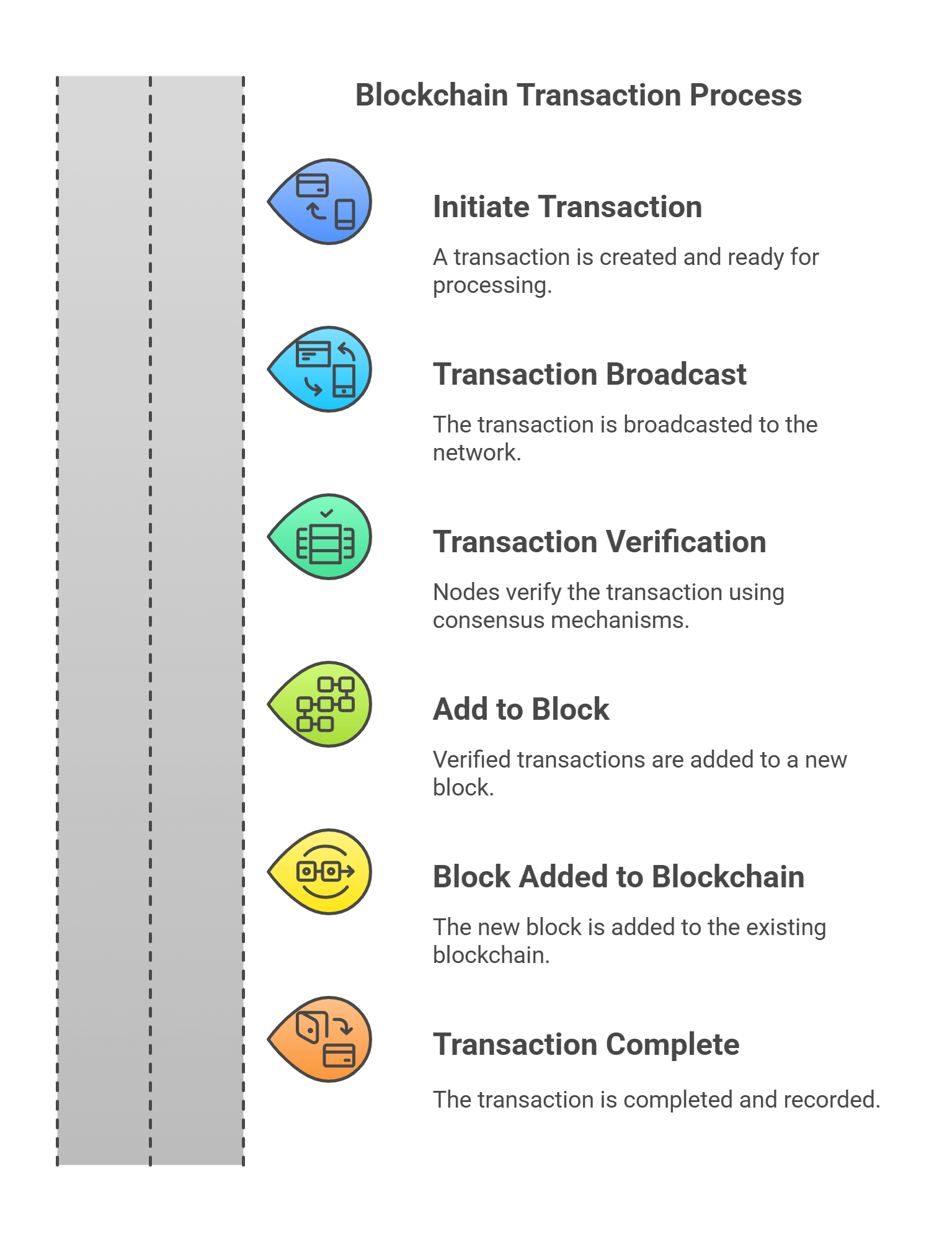

Blockchain operates as a decentralized ledger that records all transactions transparently and securely. Each block contains data, a timestamp, and a cryptographic hash of the previous block, ensuring a tamper-proof system.

- Consensus Mechanisms: Proof of Work (PoW) and Proof of Stake (PoS) validate transactions.

- Distributed Network: No central authority; all participants (nodes) maintain a copy of the ledger.

- Example: A Bitcoin transaction is verified by miners using PoW, ensuring its authenticity before adding it to the blockchain.

Explained Simply: Blockchain is like a chain of locked boxes, where each box stores a record and is linked to the previous one, making it nearly impossible to tamper with.

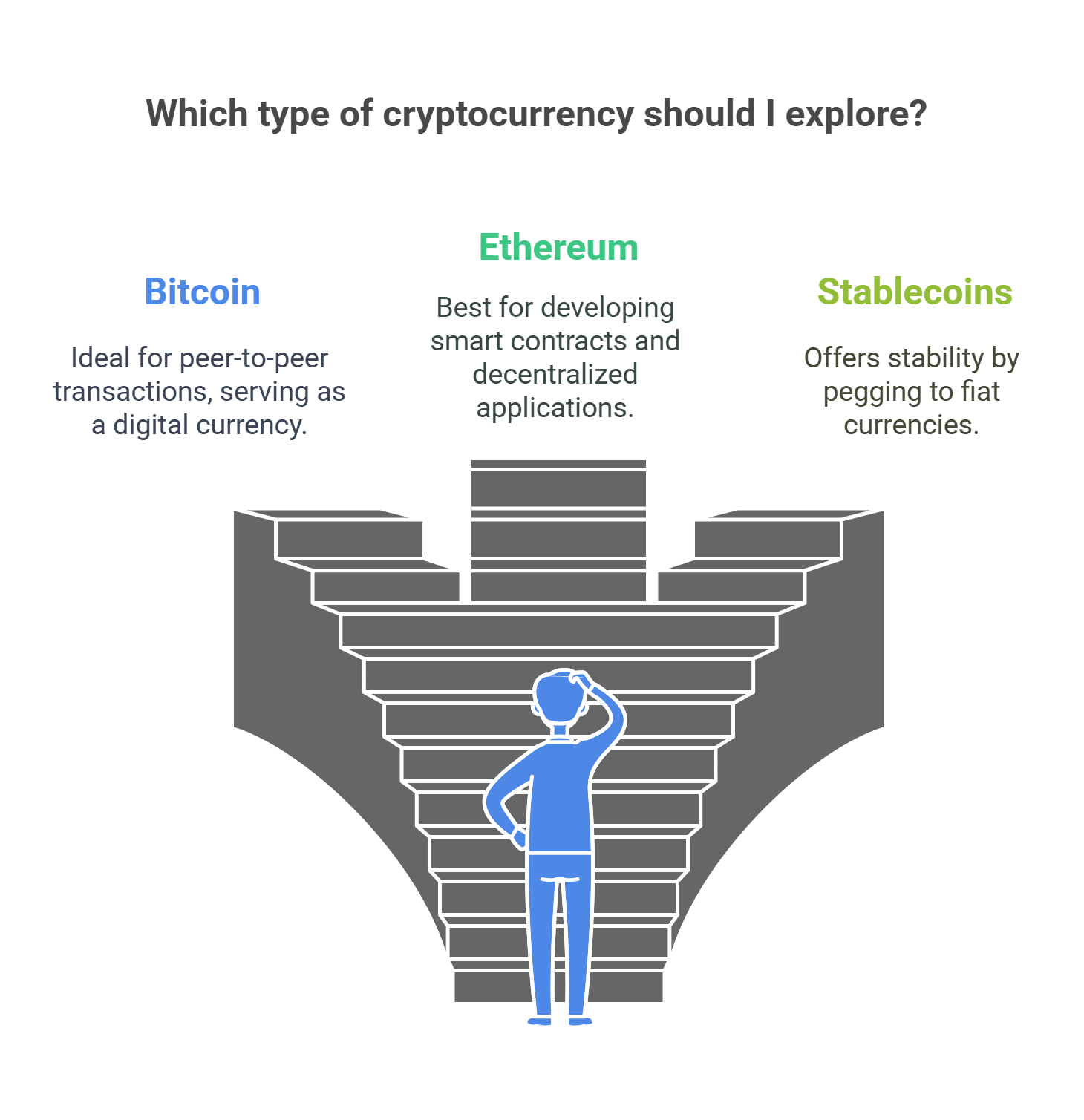

3. Types of Cryptocurrencies

Cryptocurrencies vary in purpose and functionality, ranging from payment systems to platforms for decentralized applications.

- Bitcoin: Primarily a digital currency for peer-to-peer transactions.

- Ethereum: Enables smart contracts and decentralized applications (dApps).

- Stablecoins: Pegged to stable assets like fiat currency (e.g., Tether, USDC).

- Altcoins: Include other cryptocurrencies like Litecoin and Cardano, offering unique features.

Explained Simply: Cryptocurrencies are like different tools in a digital toolbox, each designed for specific tasks, from transactions to running apps.

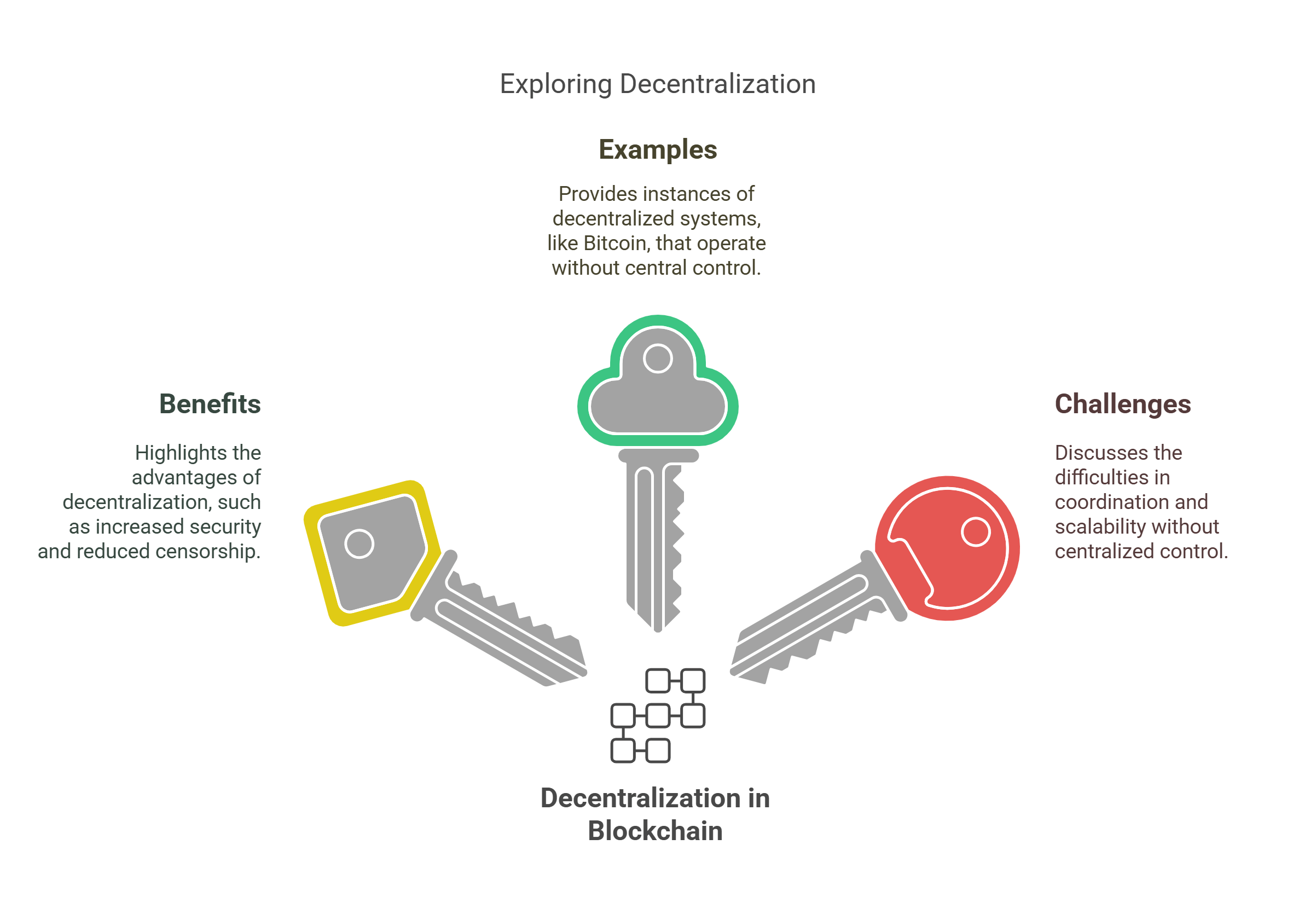

4. Decentralization in Blockchain

Decentralization means that no single entity controls the blockchain network. Decisions are made collectively by participants, ensuring transparency and reducing the risk of manipulation.

- Benefits: Increases security, reduces censorship, and eliminates reliance on intermediaries.

- Examples: Bitcoin operates without a central bank, relying on miners to validate transactions.

- Challenges: Coordination and scalability can be difficult without centralized control.

Explained Simply: Decentralization is like a town hall meeting where everyone has a say, rather than one person making all the decisions.

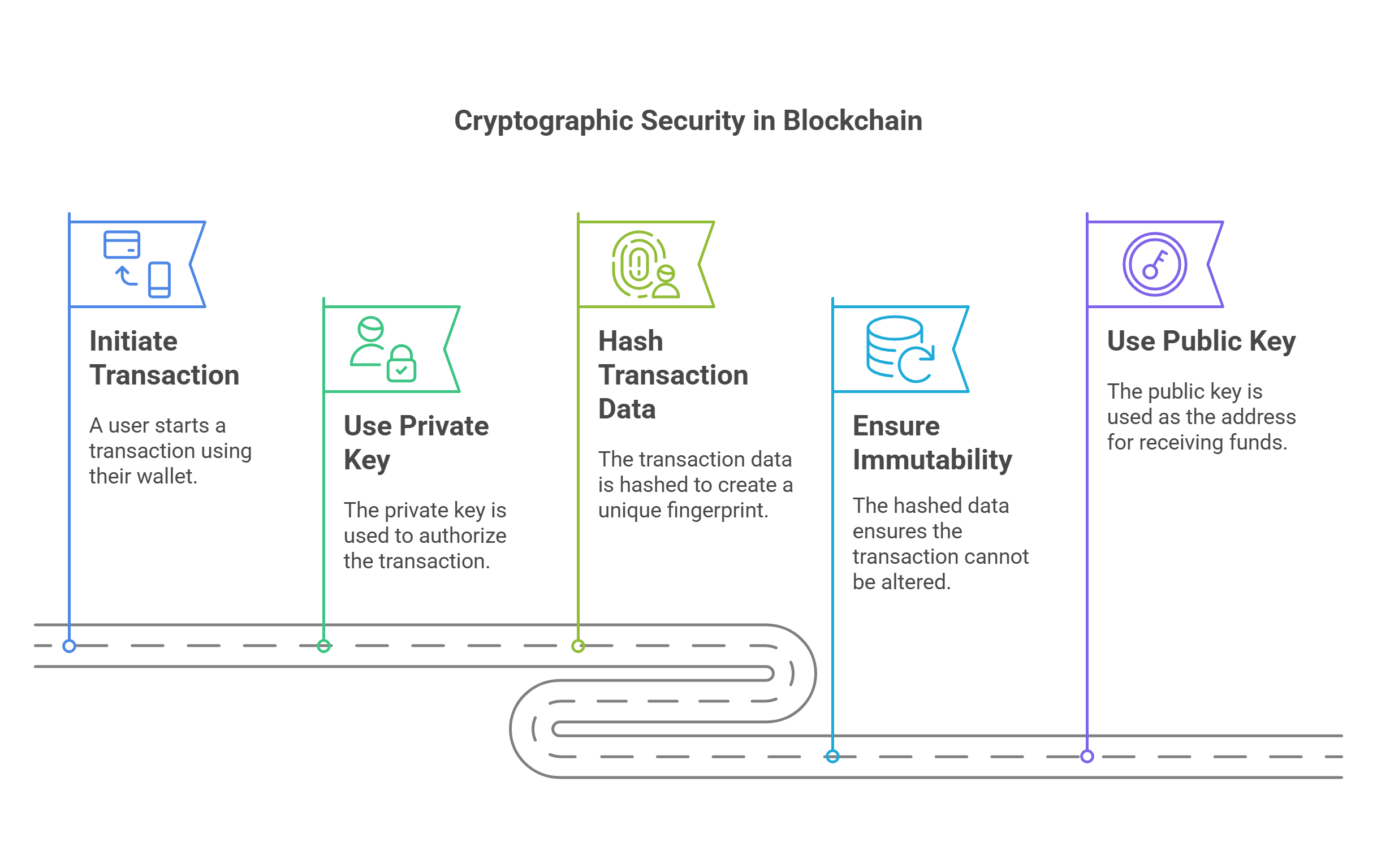

5. Cryptographic Security in Blockchain

Blockchain relies on cryptographic techniques to secure transactions and protect user data.

- Public and Private Keys: Ensure secure access and transfer of cryptocurrencies.

- Hashing: Converts transaction data into unique digital fingerprints, ensuring immutability.

- Example: A Bitcoin wallet uses a private key to authorize transactions, while the public key serves as the address for receiving funds.

Explained Simply: Cryptography in blockchain is like a secret code that keeps your digital money safe and transactions secure.

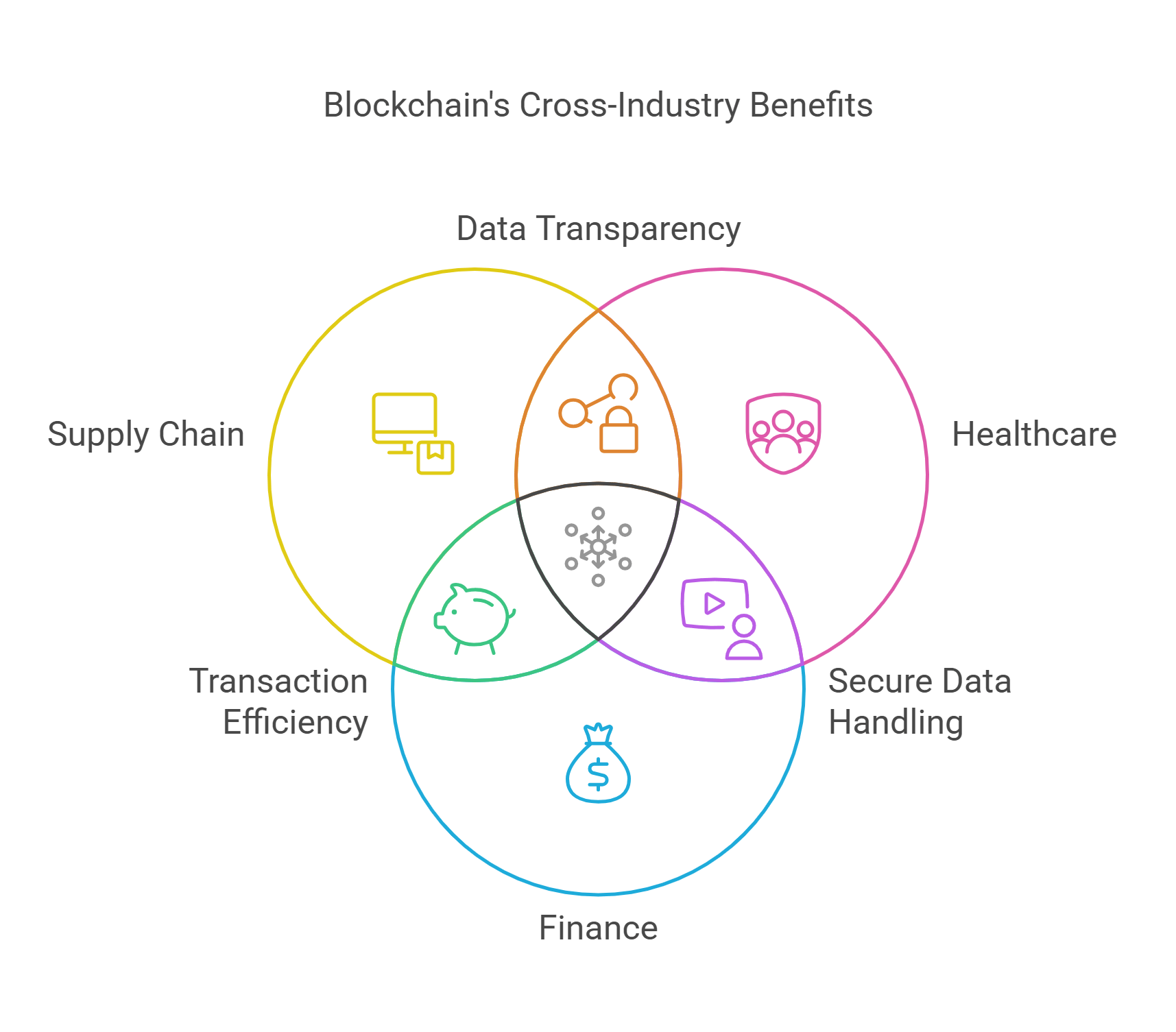

6. Applications of Blockchain Beyond Cryptocurrencies

Blockchain has applications beyond digital currencies, revolutionizing industries like supply chain, healthcare, and finance.

- Supply Chain: Tracks goods from production to delivery, ensuring transparency.

- Healthcare: Protects patient records and enables secure data sharing.

- Finance: Facilitates cross-border payments and reduces transaction costs.

- Example: IBM’s Food Trust uses blockchain to trace food supply chains, enhancing safety and accountability.

Explained Simply: Blockchain is like a versatile toolkit, solving problems across industries beyond just money.

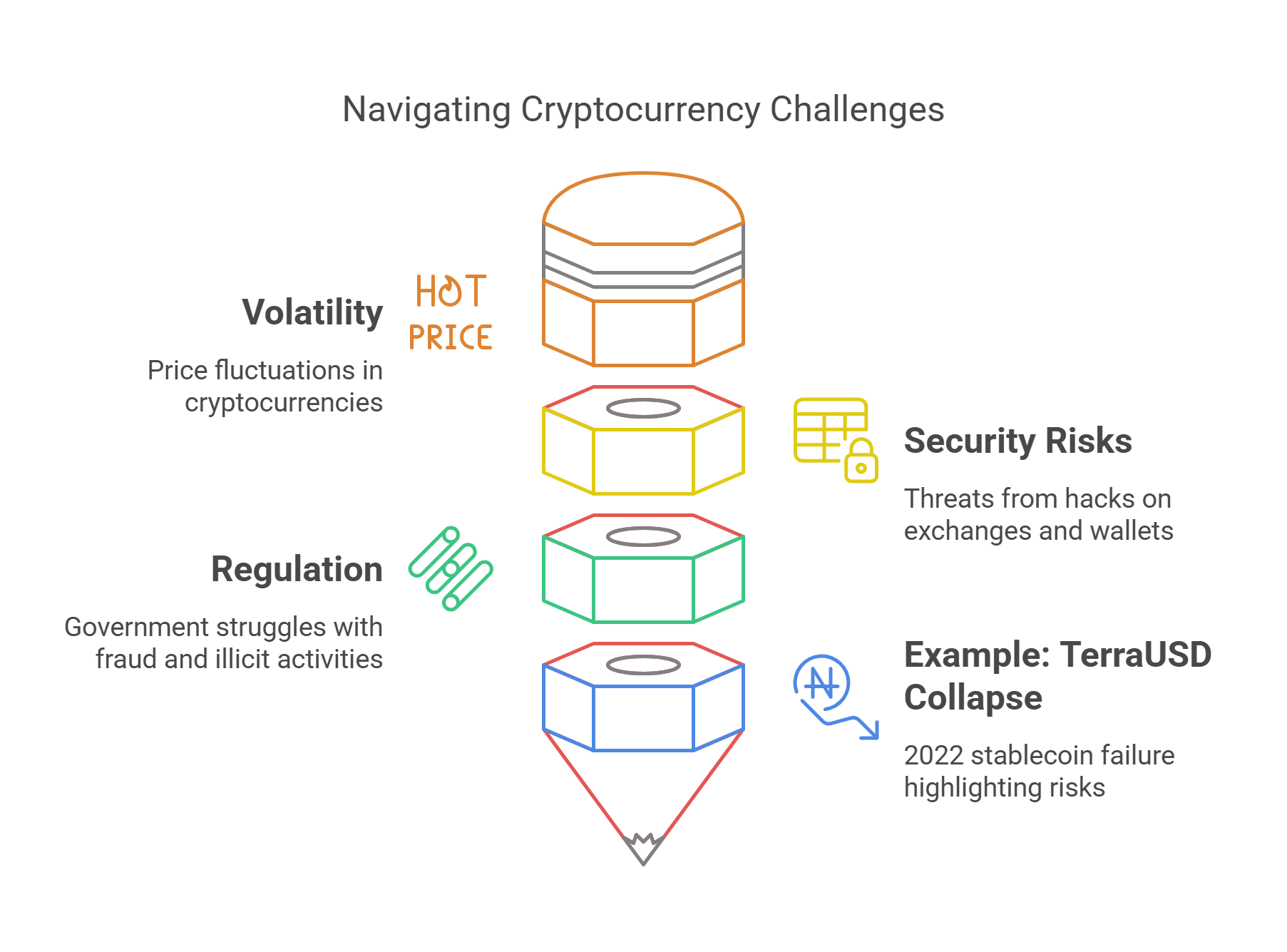

7. Challenges and Criticisms of Cryptocurrencies

Despite their benefits, cryptocurrencies face significant challenges and criticisms, including volatility and security concerns.

- Volatility: Prices can fluctuate wildly, as seen with Bitcoin.

- Security Risks: Hacks on exchanges and wallets pose threats.

- Regulation: Governments struggle to address fraud and illicit activities.

- Example: The 2022 collapse of TerraUSD highlighted the risks of poorly designed stablecoins.

Explained Simply: Cryptocurrencies are exciting but can be risky, like riding a rollercoaster without a safety harness.

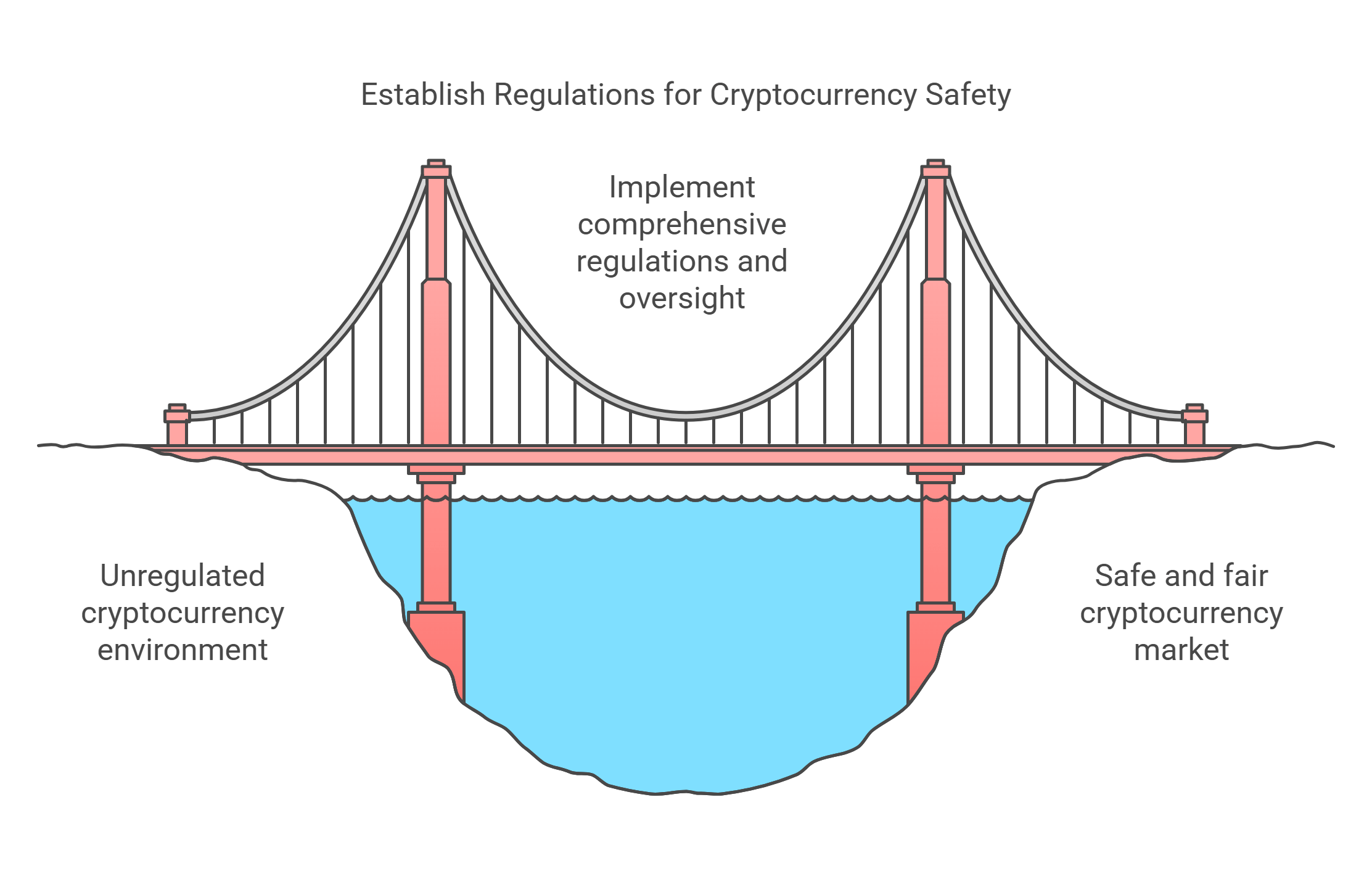

8. Regulation and Legal Frameworks

Governments and institutions are working to regulate cryptocurrencies and blockchain technology to ensure fairness and prevent misuse.

- Examples of Regulation: The U.S. Securities and Exchange Commission (SEC) monitors initial coin offerings (ICOs).

- Benefits: Protects consumers, reduces fraud, and legitimizes the industry.

- Challenges: Striking a balance between innovation and oversight.

Explained Simply: Regulation is like building traffic rules for the crypto highway to keep everyone safe.

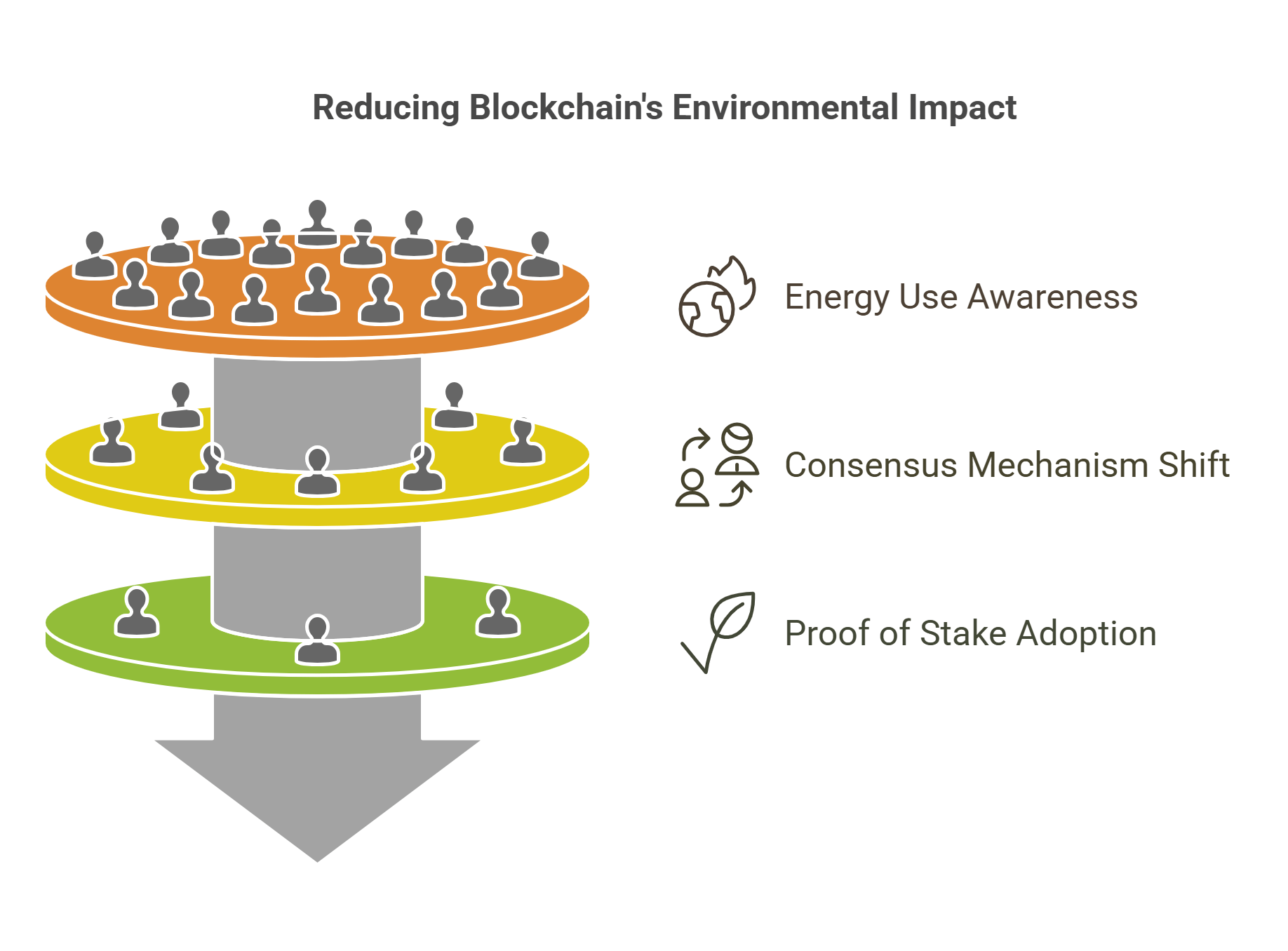

9. Environmental Impact of Blockchain

Blockchain networks, especially those using Proof of Work, consume significant energy, raising concerns about sustainability.

- Energy Use: Bitcoin mining uses as much energy as some small countries.

- Solutions: Transitioning to energy-efficient consensus mechanisms like Proof of Stake.

- Example: Ethereum’s switch to Proof of Stake reduced its energy consumption by over 99%.

Explained Simply: Blockchain’s environmental impact is like running a power-hungry machine, but newer designs aim to make it greener.

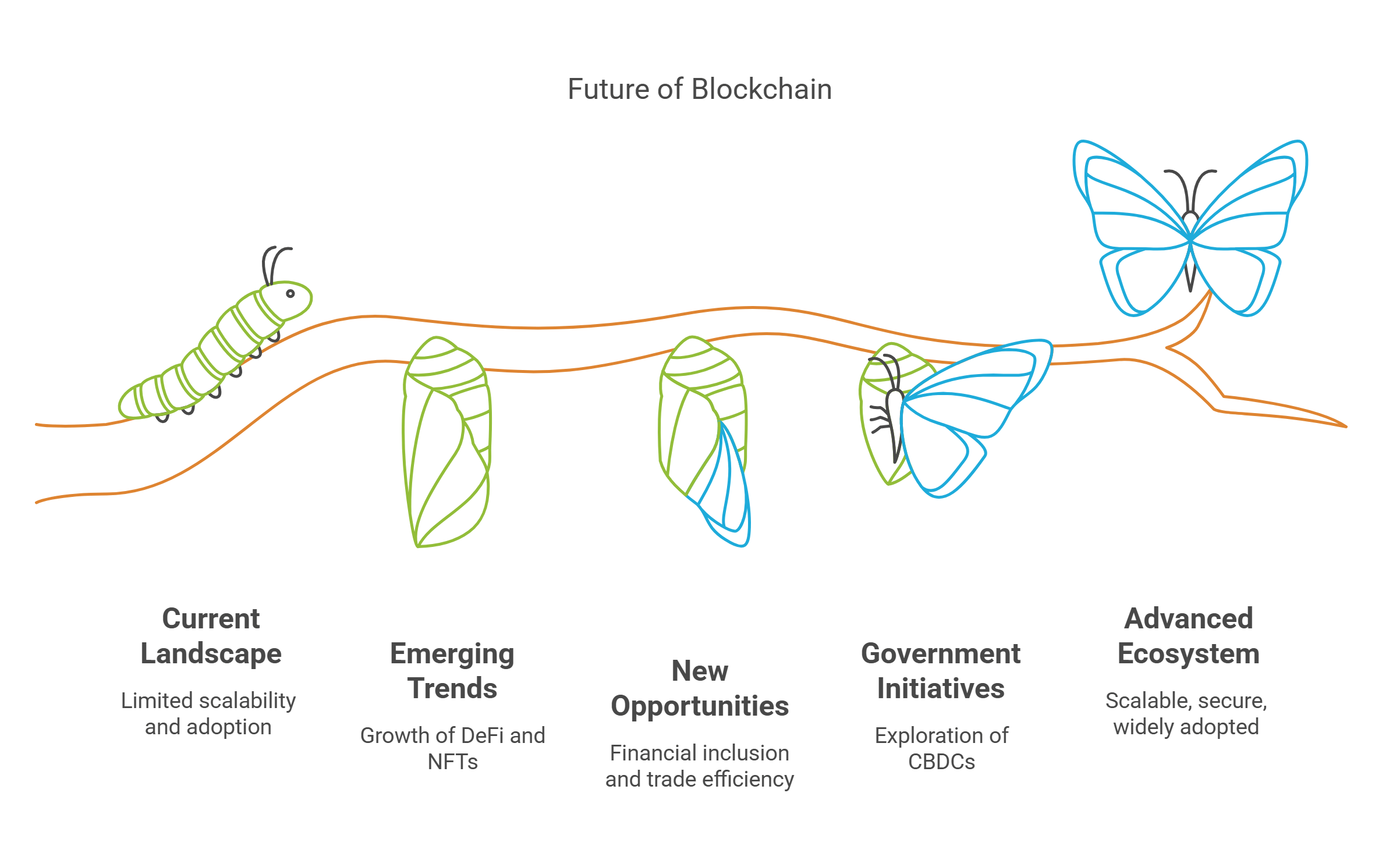

10. The Future of Blockchain and Cryptocurrencies

The future of blockchain and cryptocurrencies involves advancements in scalability, security, and adoption across industries.

- Trends: Development of decentralized finance (DeFi) and non-fungible tokens (NFTs).

- Opportunities: Enhancing financial inclusion and streamlining global trade.

- Example: Governments exploring central bank digital currencies (CBDCs) to complement traditional fiat systems.

Explained Simply: The future of blockchain and cryptocurrencies is like exploring uncharted territory, full of potential and challenges.

✨ Conclusion

Cryptocurrencies and blockchain technology are reshaping finance, technology, and society. By mastering concepts like decentralization, cryptographic security, and blockchain applications, readers can better analyze RC passages on this transformative topic. Understanding both the opportunities and challenges of blockchain equips us to navigate its evolving landscape. 💰