Economics: Essential Concepts for Reading Comprehension

Introduction

Economics is not just about numbers and markets—it’s a lens through which we understand human behavior, societal priorities, and global systems. For reading comprehension passages, particularly on standardized tests like the CAT and GMAT, economic concepts often serve as a foundation for analyzing arguments, evaluating trends, and understanding critical issues. Familiarity with these ideas helps you decode passages that discuss policies, financial trends, or philosophical debates on resource distribution.

Overview

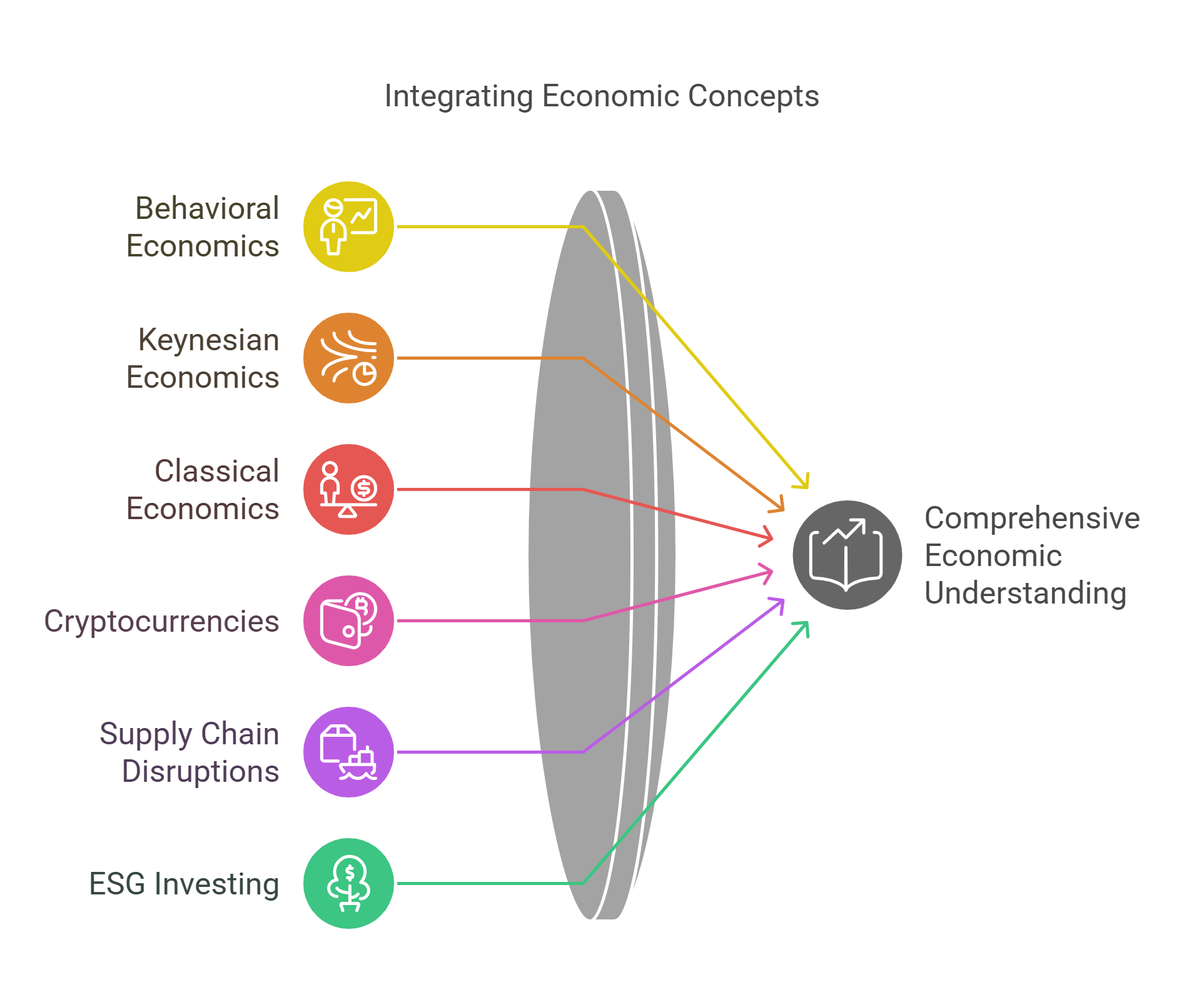

In this guide, we’ll explore these key economics-related concepts:

- Behavioral Economics

- Keynesian Economics

- Classical Economics

- Cryptocurrencies

- Supply Chain Disruptions

- ESG Investing

- Inflation

- Fiscal Policy

- Monetary Policy

- Market Equilibrium

Detailed Explanations

1. Behavioral Economics

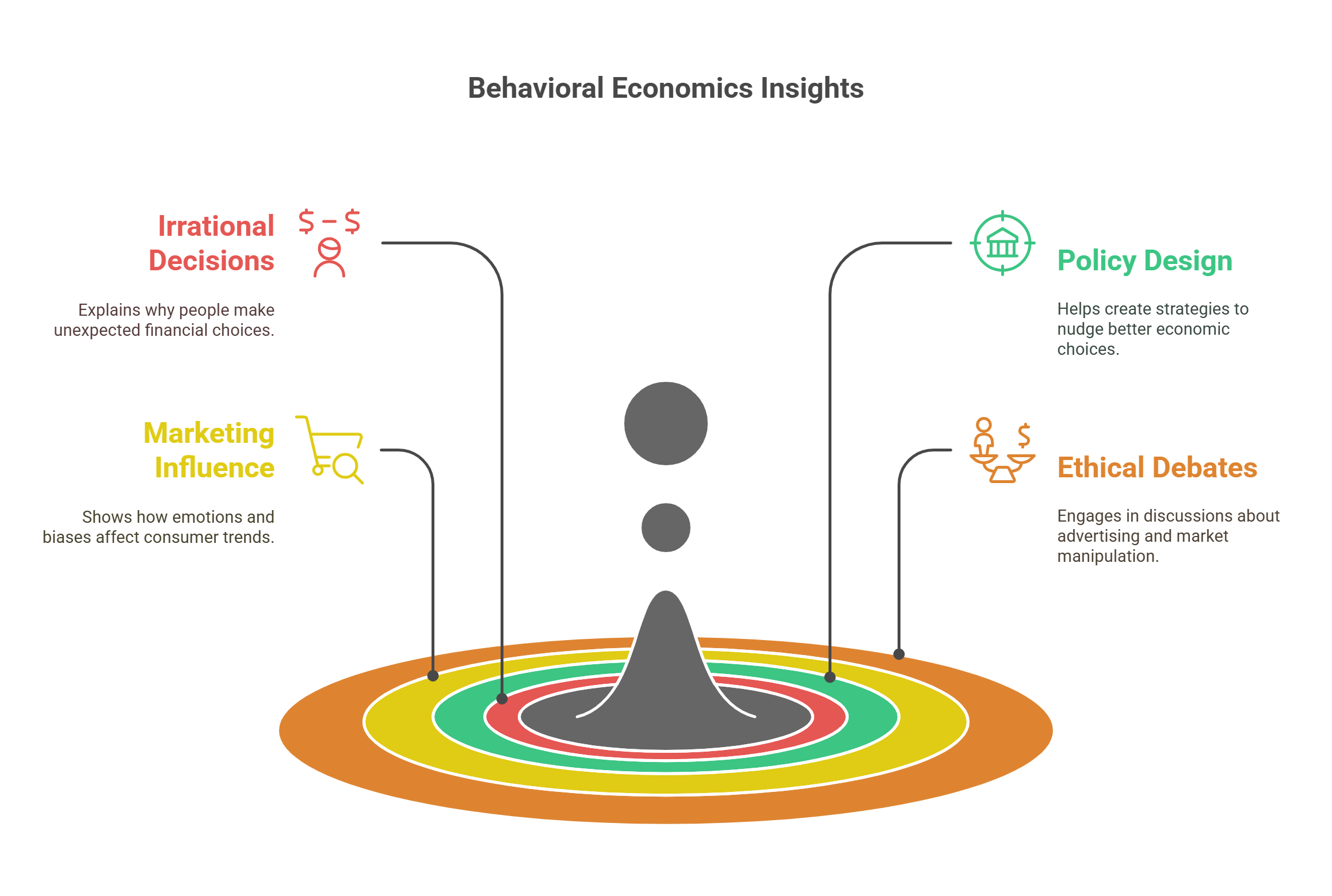

Behavioral economics combines psychology and economics to explain why people make irrational financial decisions. Unlike traditional economics, which assumes humans act logically, this field explores how emotions, biases, and social influences shape economic behavior. It’s particularly relevant in understanding consumer trends, market failures, and policy designs aimed at “nudging” better decisions.

- Challenges the assumption of purely rational decision-making.

- Explains phenomena like impulse buying or saving procrastination.

- Helps design policies to encourage healthy or sustainable choices.

- Relevant in debates on the ethics of advertising and market manipulation.

- Influences modern marketing and economic models.

How Would You Explain This to a 10-Year-Old?

Imagine you have candy and a savings jar. A “smart” choice is to save the candy for later, but sometimes, you eat it right away because it looks so good. Behavioral economics studies why we make those choices and how to help people save the candy for later.

2. Keynesian Economics

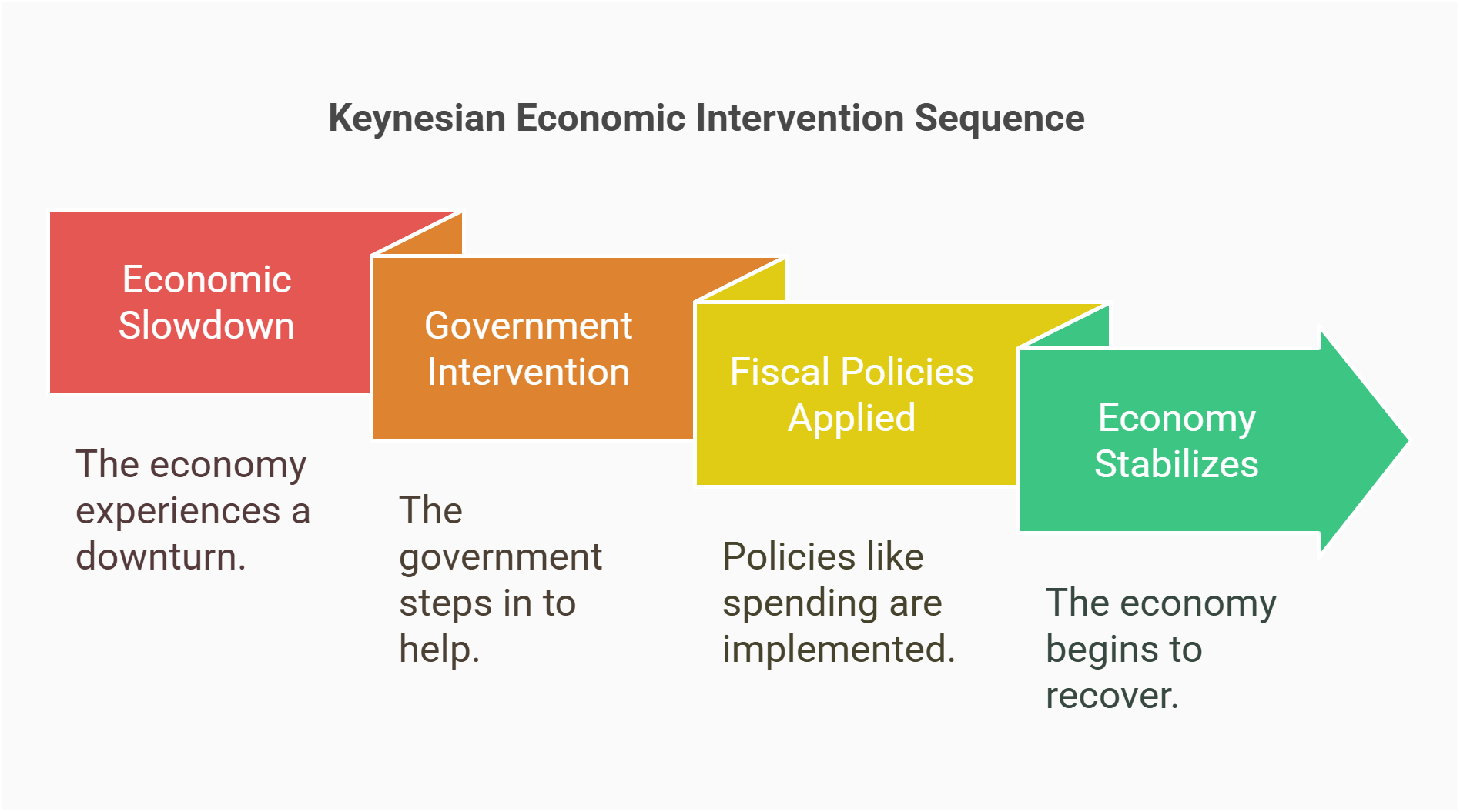

Keynesian economics focuses on how government spending and taxation can stabilize the economy. Developed during the Great Depression by John Maynard Keynes, it emphasizes the importance of demand in driving growth and proposes active intervention during recessions or economic downturns.

- Advocates for government intervention to manage demand.

- Suggests using fiscal policies to combat unemployment and recessions.

- Critiques laissez-faire or hands-off economic approaches.

- Supports deficit spending during economic slowdowns.

- Influential during the 2008 financial crisis recovery.

How Would You Explain This to a 10-Year-Old?

Think of the economy as a car. If it slows down too much, the government gives it a “push” by building roads, schools, and other projects. This “push” helps the car go faster again.

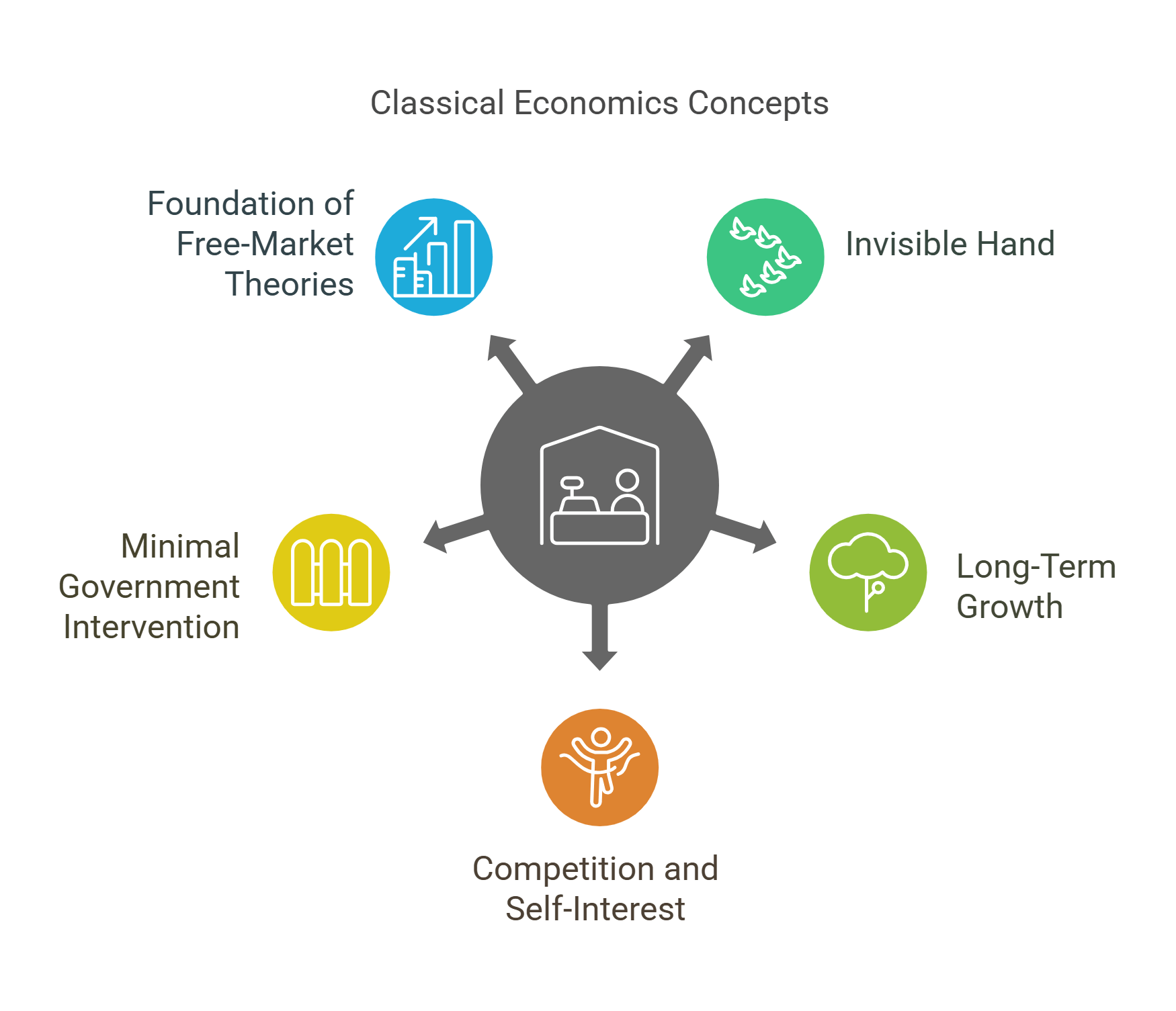

3. Classical Economics

Classical economics is based on the idea that free markets regulate themselves when free of interference. It emphasizes supply and demand as the key drivers of economic growth and posits that minimal government intervention leads to efficient resource allocation.

- Promotes the “invisible hand” of the market.

- Focuses on long-term growth and production.

- Relies on competition and self-interest to achieve efficiency.

- Opposes excessive government regulation.

- Forms the foundation of modern free-market theories.

How Would You Explain This to a 10-Year-Old?

Imagine a market where kids trade toys. If everyone plays fair, the market naturally balances—kids trade what they don’t want for what they do. That’s how classical economics sees the world working.

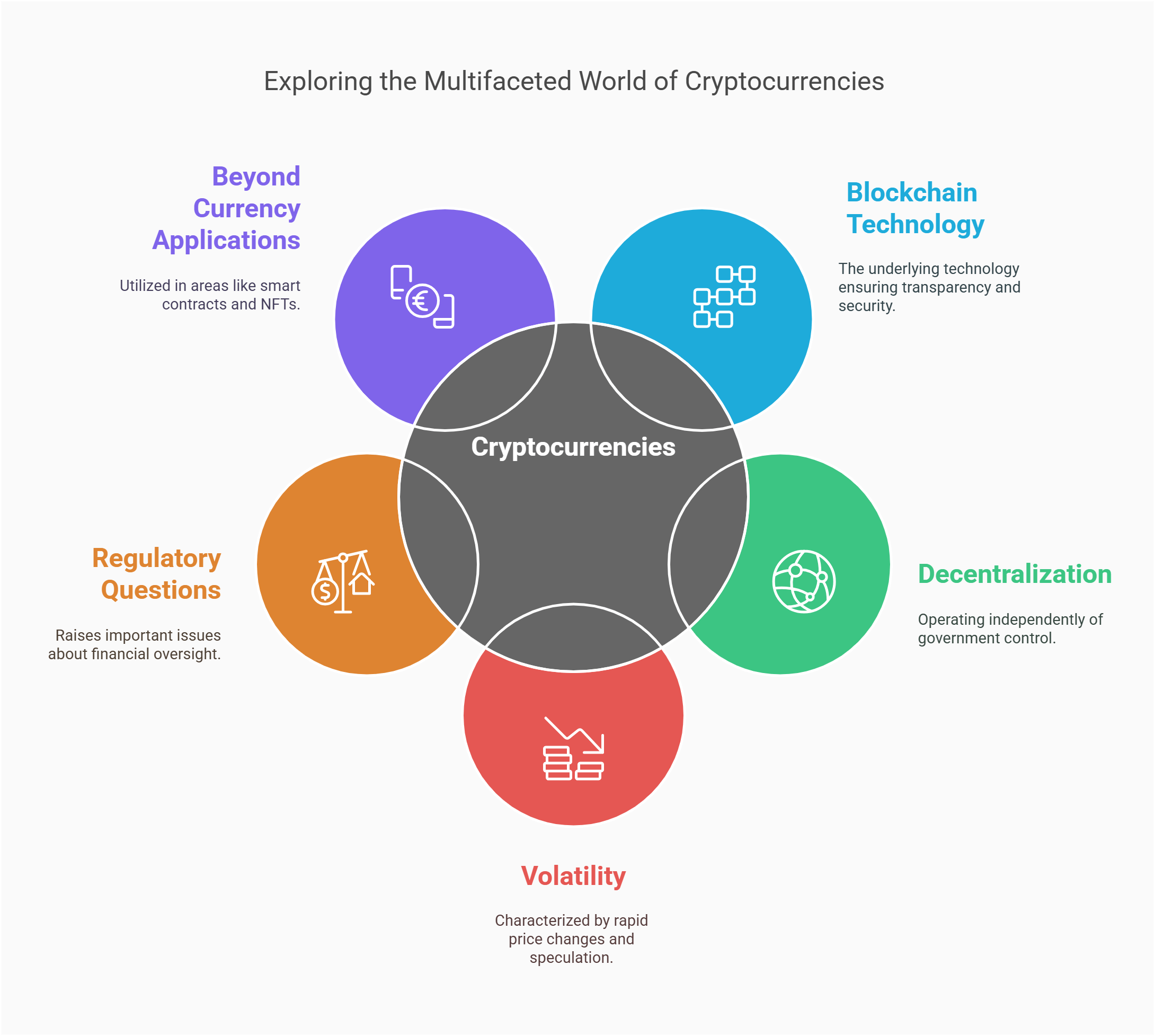

4. Cryptocurrencies

Cryptocurrencies, like Bitcoin and Ethereum, are digital currencies that use blockchain technology for secure and decentralized transactions. Unlike traditional money, they are not controlled by governments or central banks, offering an alternative financial system.

- Operates on blockchain technology for transparency and security.

- Decentralized and immune to government control.

- Volatile and speculative, often compared to digital gold.

- Raises questions about financial regulation and stability.

- Has applications beyond currency, like smart contracts and NFTs.

How Would You Explain This to a 10-Year-Old?

Imagine if instead of trading real coins, you traded secret codes on the internet. These codes work like money but aren’t controlled by any single person or country—they’re like magic coins everyone can trust.

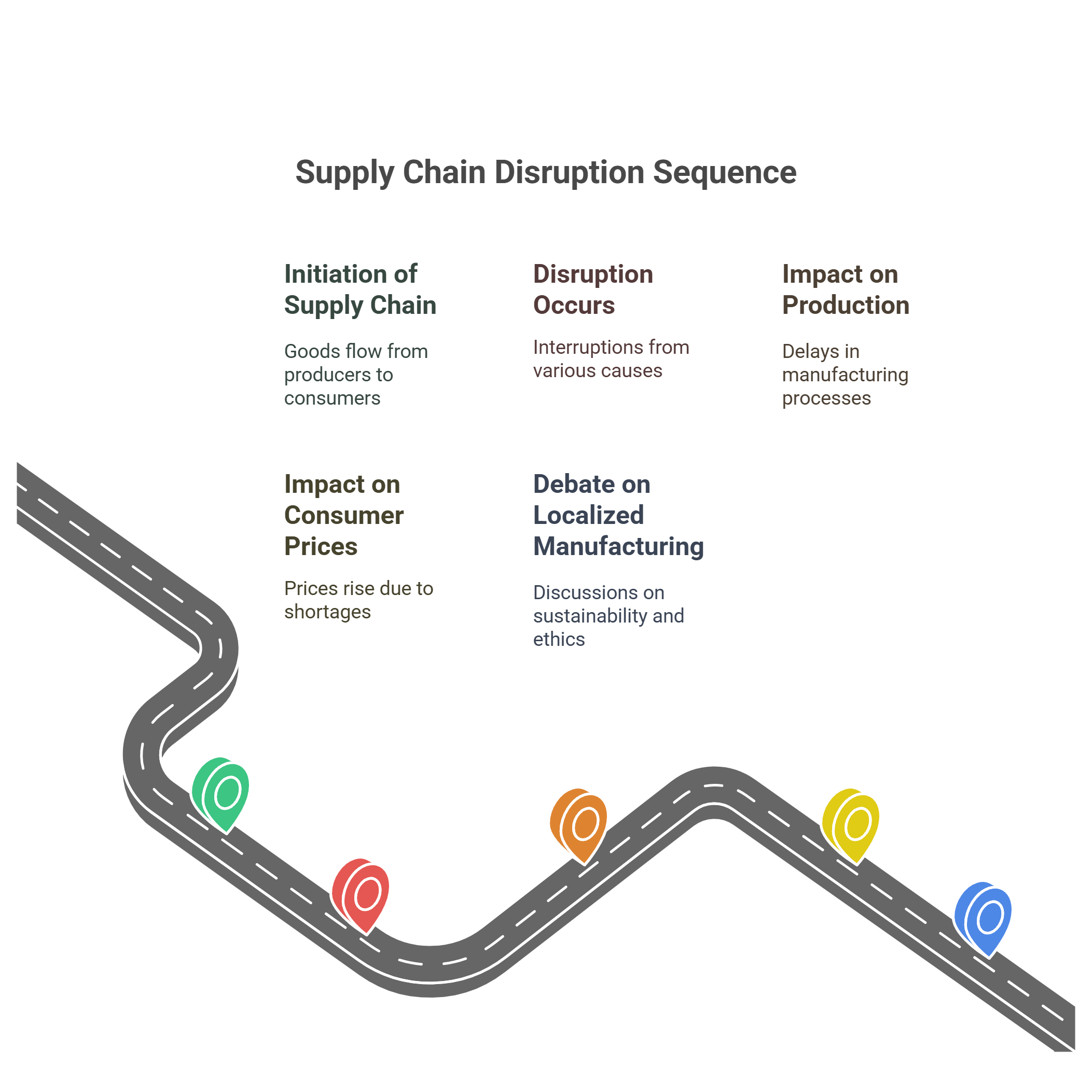

5. Supply Chain Disruptions

Supply chain disruptions occur when the flow of goods from producers to consumers is interrupted. These disruptions can result from natural disasters, pandemics, or geopolitical issues, leading to shortages and price increases.

- Highlights the fragility of global trade networks.

- Commonly caused by labor strikes, transportation delays, or crises like COVID-19.

- Impacts production timelines and consumer prices.

- Spurs debates on the need for localized manufacturing and sustainability.

- Raises ethical questions about labor conditions in global supply chains.

How Would You Explain This to a 10-Year-Old?

Imagine if your toy factory needed parts from far away, but a big storm stopped the trucks from delivering those parts. Now the factory can’t make toys, and you have to wait longer for your favorite one.

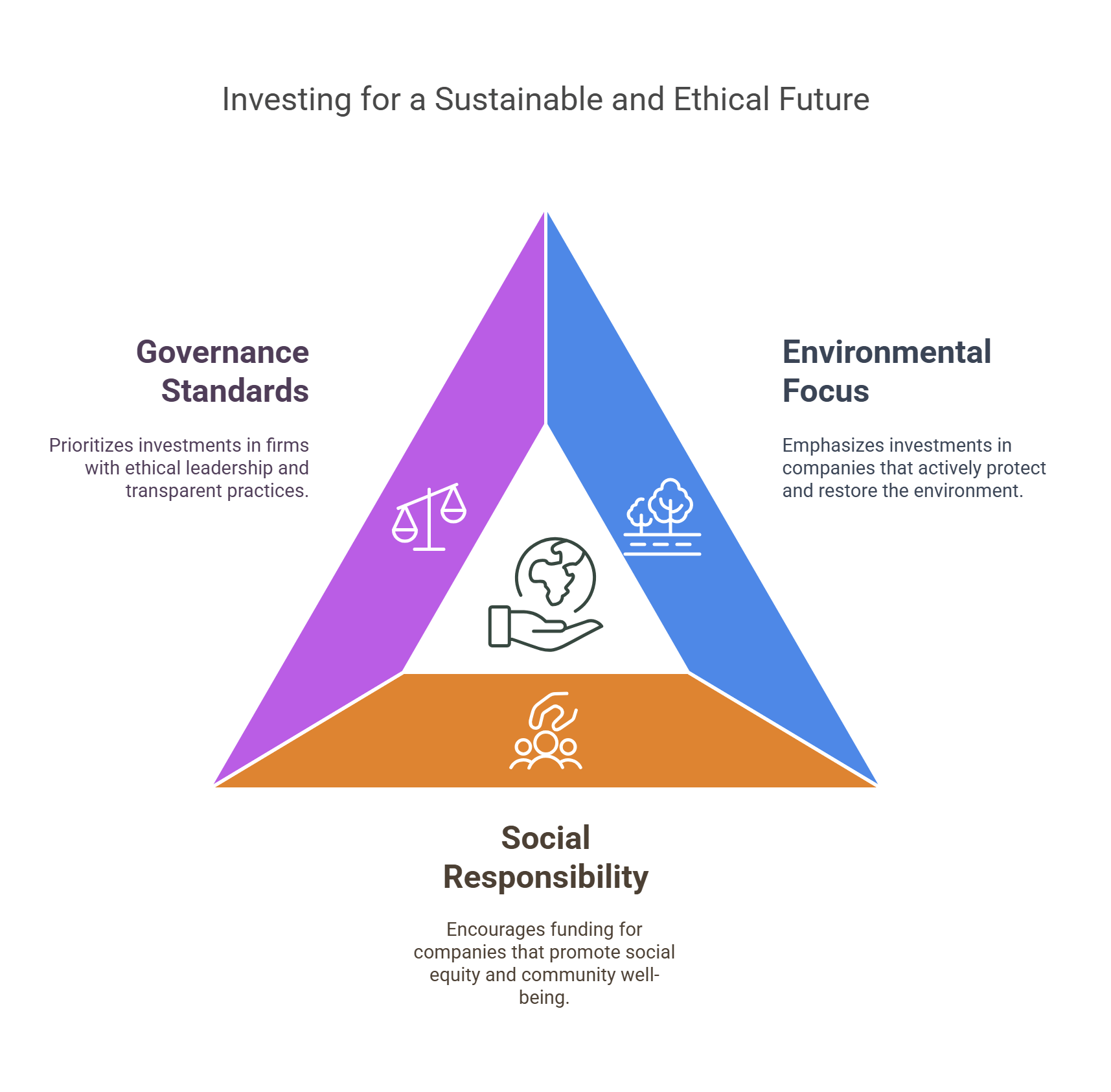

6. ESG Investing

ESG (Environmental, Social, and Governance) investing focuses on financial decisions that prioritize sustainability, ethical practices, and responsible governance. Investors look at how companies address climate change, social equity, and ethical leadership alongside financial returns.

- Stands for Environmental, Social, and Governance.

- Encourages investing in socially responsible companies.

- Balances profit-making with positive societal impact.

- Highlights the role of corporations in addressing global challenges.

- Raises questions about “greenwashing” and genuine responsibility.

How Would You Explain This to a 10-Year-Old?

Imagine choosing to buy toys only from companies that plant trees or help kids in need. ESG investing is like giving your money to companies that try to make the world a better place.

7. Inflation

Inflation is the increase in prices over time, meaning the same amount of money buys fewer goods. It’s a natural part of economies but can become problematic if it rises too quickly. Central banks, like the Federal Reserve, manage inflation through policies that balance economic growth and price stability.

- Measured by the Consumer Price Index (CPI) or other metrics.

- Causes include increased demand, production costs, or monetary policy.

- Moderate inflation is healthy; hyperinflation can destabilize economies.

- Affects wages, savings, and purchasing power.

- Central banks use interest rates to control inflation.

How Would You Explain This to a 10-Year-Old?

Imagine if candy costs one coin today, but next year it costs two coins. That’s inflation—it makes your coins less valuable over time.

8. Fiscal Policy

Fiscal policy refers to how governments use spending and taxation to influence the economy. During recessions, governments may increase spending to stimulate growth, while during booms, they might cut spending to prevent overheating.

- Key tool for managing economic cycles.

- Includes government spending on infrastructure, education, or healthcare.

- Tax policies influence consumer and business behavior.

- Aims to reduce unemployment and promote growth.

- Can lead to debates over public debt and long-term impacts.

How Would You Explain This to a 10-Year-Old?

Think of the government like a parent who saves or spends money to keep the household running smoothly. When things are tough, they might spend more to make sure everyone’s okay.

9. Monetary Policy

Monetary policy involves controlling the money supply and interest rates to manage economic stability. Central banks, like the Reserve Bank of India, use tools such as setting interest rates or buying bonds to influence inflation, unemployment, and growth.

- Controlled by central banks, not governments.

- Lower interest rates encourage borrowing and spending.

- Higher interest rates reduce inflation by curbing demand.

- Influences currency value and global trade competitiveness.

- Balances economic growth with price stability.

How Would You Explain This to a 10-Year-Old?

Imagine a magical water tap for money. If there’s too much water (money), everything gets wet and messy (inflation). If there’s too little, people get thirsty (recession). The central bank decides how much water to let out.

10. Market Equilibrium

Market equilibrium occurs when supply equals demand, creating stable prices. It’s a fundamental concept in economics, demonstrating how markets adjust naturally over time to changes in supply, demand, or external factors.

- Balances quantity supplied and demanded at a particular price.

- Explains price stability in competitive markets.

- Shifts when factors like production costs or consumer preferences change.

- Central to understanding market efficiency.

- Helps explain surplus, shortage, and price fluctuations.

How Would You Explain This to a 10-Year-Old?

Imagine a lemonade stand where you make just enough lemonade to sell to thirsty kids. No one is left without a drink, and you don’t have any leftover. That’s market equilibrium.

Conclusion

Economics concepts are foundational for interpreting reading comprehension passages that explore policies, market dynamics, and societal trends. By understanding these principles, you can better analyze arguments, evaluate trends, and engage thoughtfully with critical economic issues. Mastery of these ideas is essential for excelling in exams and applying insights to real-world scenarios.