📊 Comparative Economics: Essential Concepts for Reading Comprehension

Comparative economics examines different economic systems, policies, and theories, analyzing how they shape resource allocation, societal well-being, and global interactions. It explores topics like the distinctions between capitalism and socialism, microeconomic versus macroeconomic dynamics, and the influence of globalization. RC passages often address debates in economic theory, the impact of policy decisions, and the outcomes of competing models. Mastering these concepts provides a robust foundation for evaluating economic phenomena.

📋 Overview

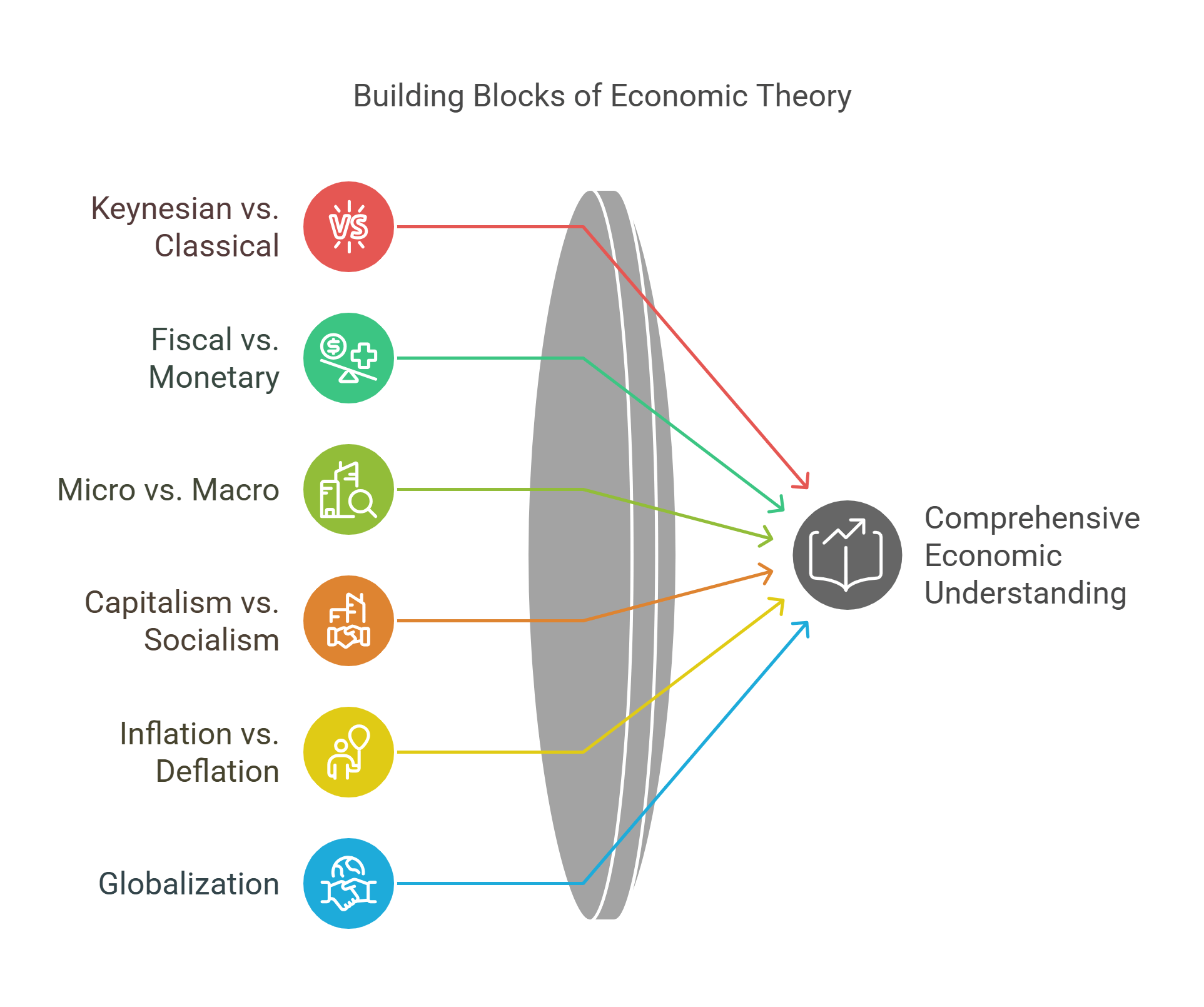

This guide explores the following essential concepts in comparative economics:

- Keynesian vs. Classical Economics

- Fiscal vs. Monetary Policy

- Micro vs. Macro Economics

- Capitalism vs. Socialism

- Inflation vs. Deflation

- Opportunity Cost

- Trade Deficit

- Market Structures

- Behavioral Economics

- Globalization

🔍 Detailed Explanations

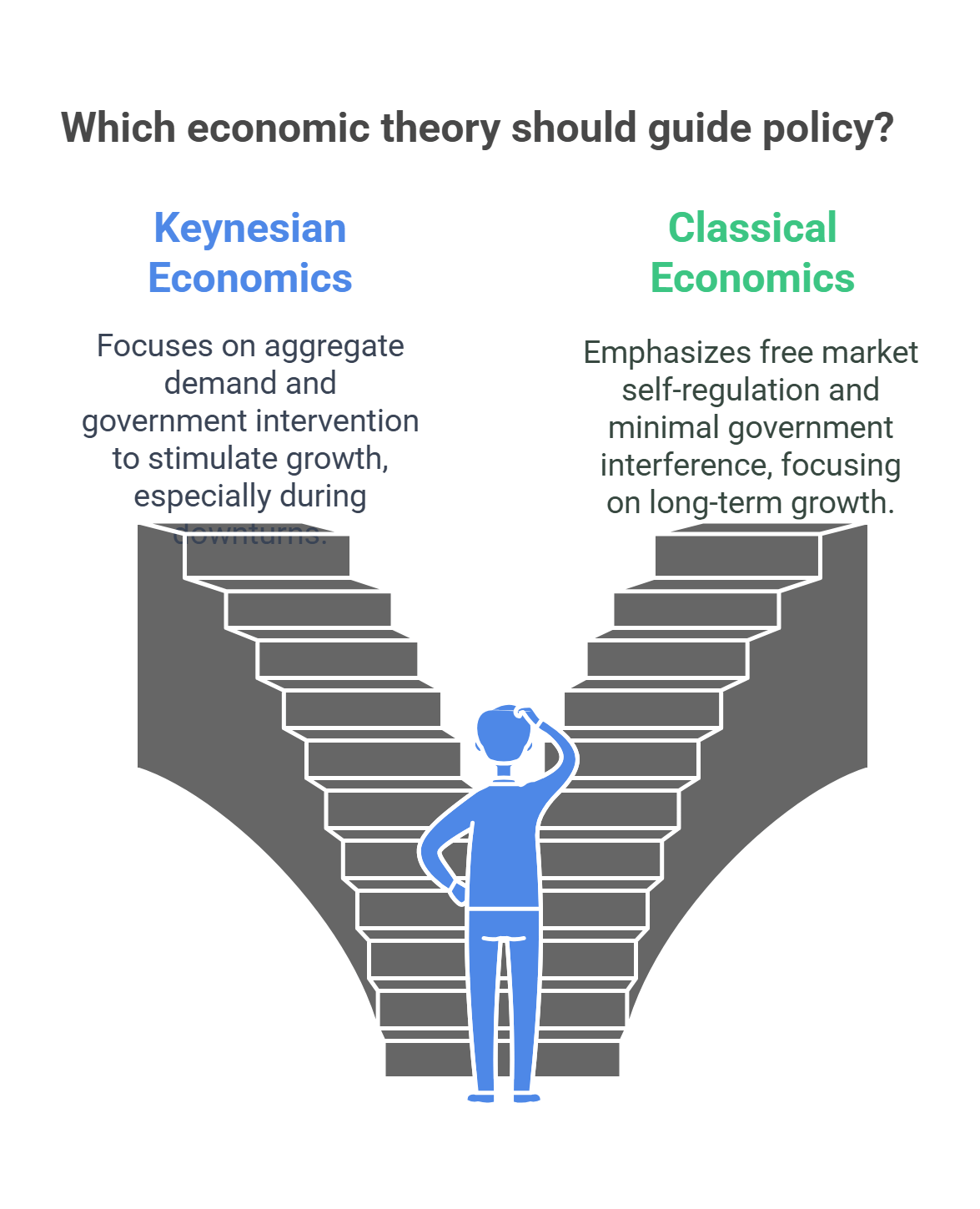

1. Keynesian vs. Classical Economics

Detailed Explanation: Keynesian and classical economics represent two contrasting schools of thought on how economies function and how governments should intervene:

- Keynesian Economics:

- Proposed by John Maynard Keynes, this theory emphasizes aggregate demand (total spending in the economy) as the driver of economic growth.

- Advocates for active government intervention through fiscal policies (e.g., increased spending or tax cuts) during economic downturns.

- Argues that without intervention, recessions can spiral into prolonged unemployment and reduced output.

- Classical Economics:

- Rooted in the ideas of Adam Smith, David Ricardo, and others, this theory assumes that free markets naturally achieve equilibrium through the laws of supply and demand.

- Emphasizes minimal government interference, focusing instead on long-term growth driven by production (supply-side factors).

Key Debate: Keynesians focus on managing short-term economic fluctuations, while classical economists prioritize long-term stability and self-regulation.

Example: During the Great Depression, Keynes advocated for massive public works programs to create jobs and stimulate demand, challenging classical ideas of market self-correction.

Explained Simply: Keynesian economics is like a doctor treating symptoms (recession) immediately, while classical economics trusts the body (market) to heal itself.

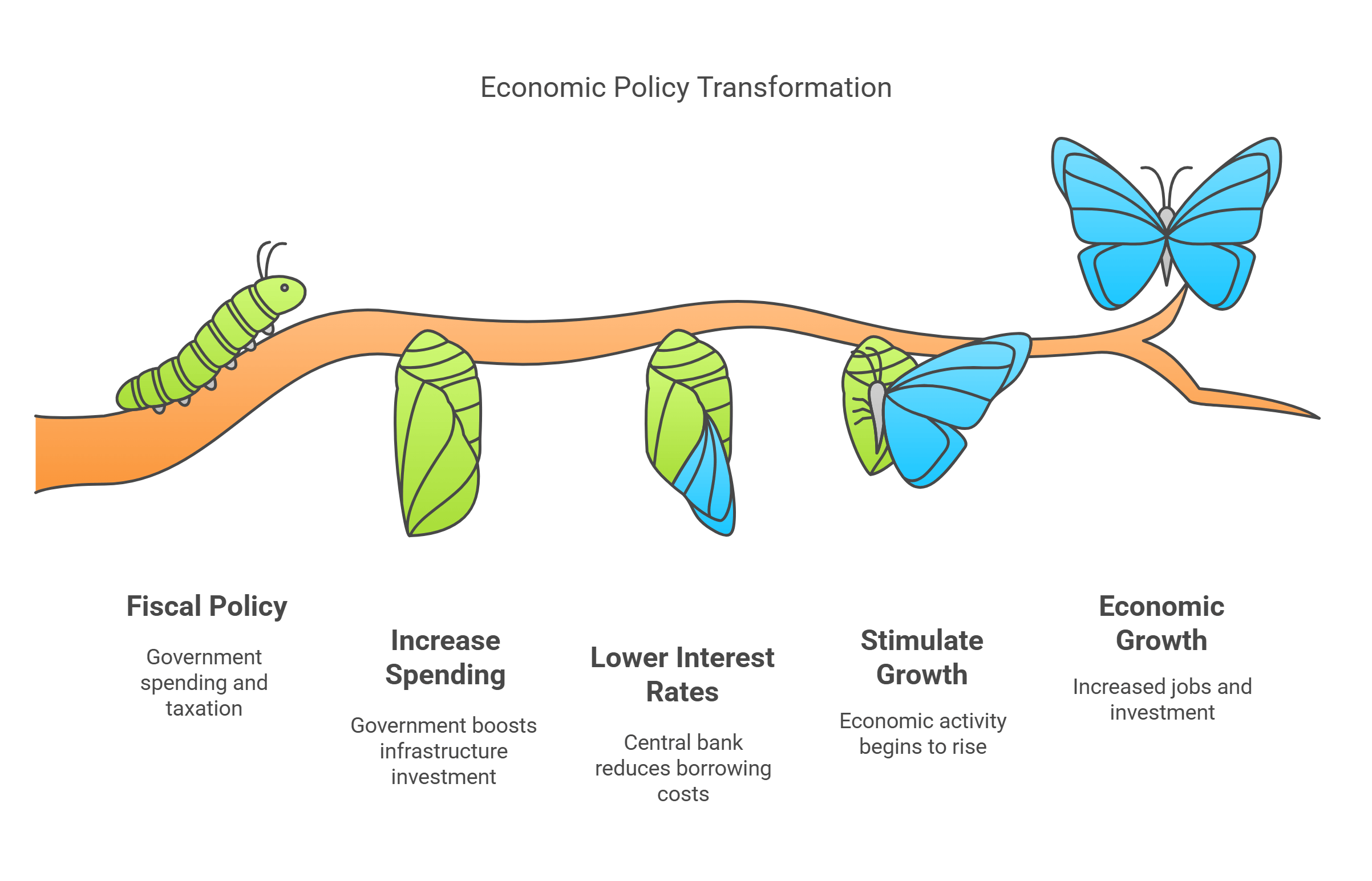

2. Fiscal vs. Monetary Policy

Detailed Explanation: Governments and central banks use fiscal and monetary policies to influence economic activity:

- Fiscal Policy:

- Enacted by governments through taxation and public spending.

- Goals: Stimulate economic growth, reduce unemployment, or control inflation.

- Example: A government increases infrastructure spending to create jobs during a recession.

- Monetary Policy:

- Managed by central banks to regulate money supply and control interest rates.

- Goals: Stabilize currency, curb inflation, or encourage investment.

- Example: A central bank lowers interest rates to make borrowing cheaper, spurring economic activity.

Key Contrast: Fiscal policy directly impacts government budgets, while monetary policy adjusts the financial environment to influence borrowing and spending behaviors.

Explained Simply: Fiscal policy is like a government steering the car, while monetary policy adjusts the road conditions.

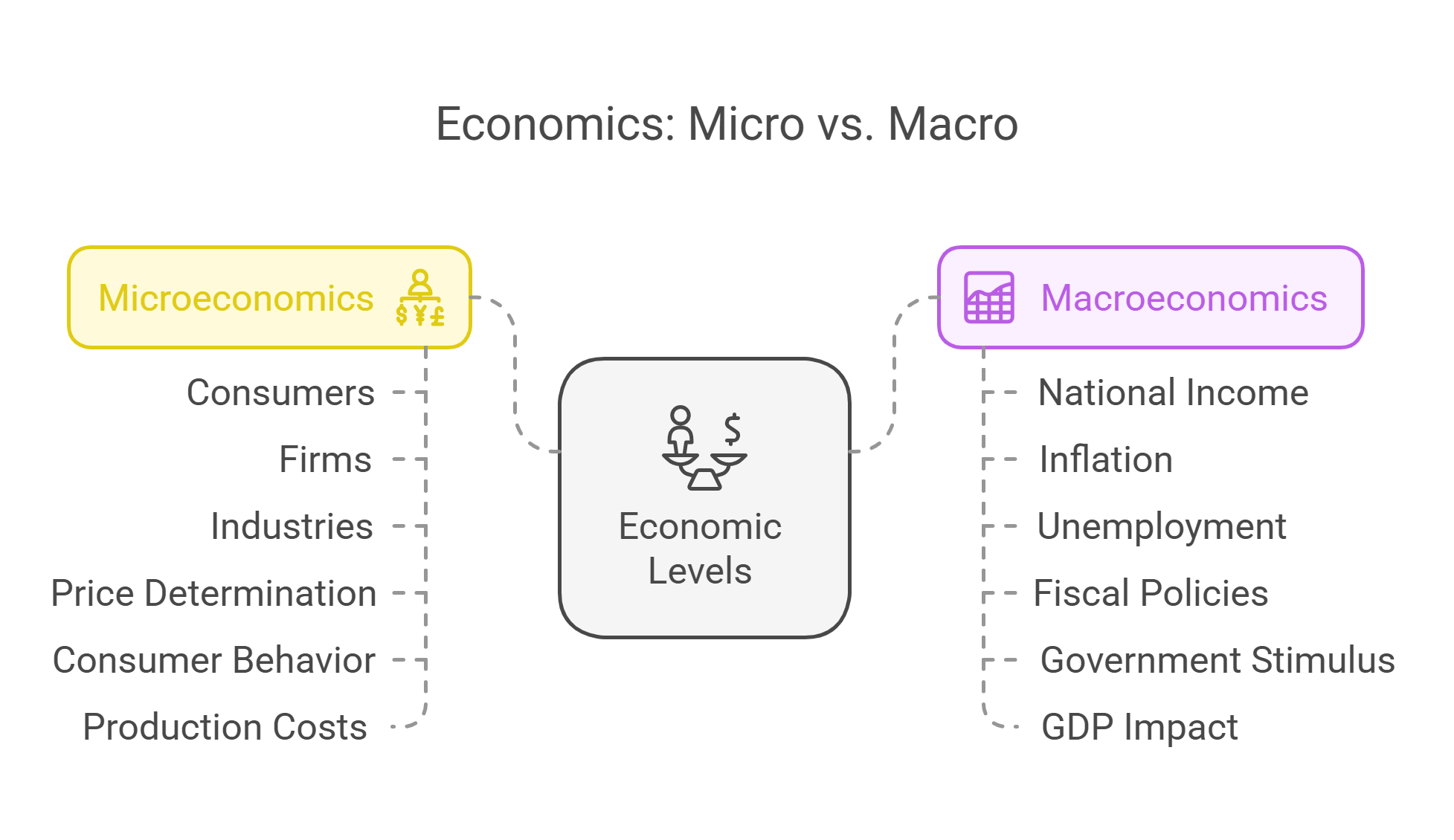

3. Micro vs. Macro Economics

Detailed Explanation: Economics operates on two levels—micro and macro—each addressing different aspects of economic activity:

- Microeconomics:

- Examines individual consumers, firms, and industries.

- Topics: Price determination, consumer behavior, production costs.

- Example: Studying how a coffee shop adjusts its prices based on supply costs and demand.

- Macroeconomics:

- Focuses on the economy as a whole.

- Topics: National income, inflation, unemployment, fiscal policies.

- Example: Analyzing how government stimulus packages affect national GDP.

Explained Simply: Microeconomics is like analyzing individual trees, while macroeconomics views the entire forest.

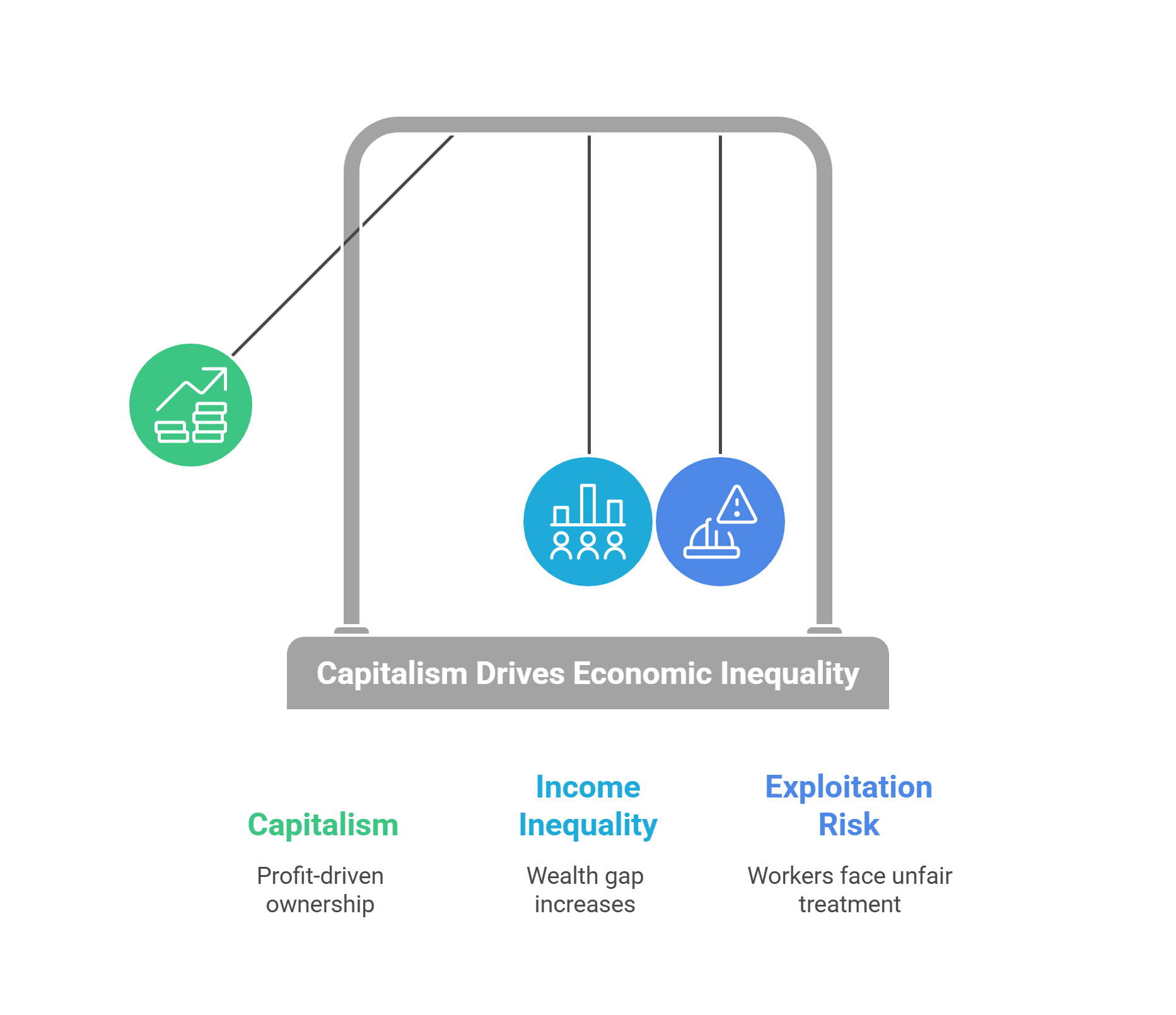

4. Capitalism vs. Socialism

Detailed Explanation: Capitalism and socialism represent competing economic systems with different approaches to ownership and resource distribution:

- Capitalism:

- Based on private ownership, profit motive, and market competition.

- Promotes innovation and efficiency through competition.

- Criticism: Can lead to income inequality and exploitation.

- Socialism:

- Advocates collective or state ownership of resources to ensure equitable distribution.

- Prioritizes social welfare and reducing economic disparities.

- Criticism: Risk of inefficiency and lack of incentives for innovation.

Example: The U.S. operates as a capitalist economy, while Nordic countries like Sweden incorporate socialist policies for healthcare and education.

Explained Simply: Capitalism is like a race rewarding winners, while socialism ensures everyone crosses the finish line together.

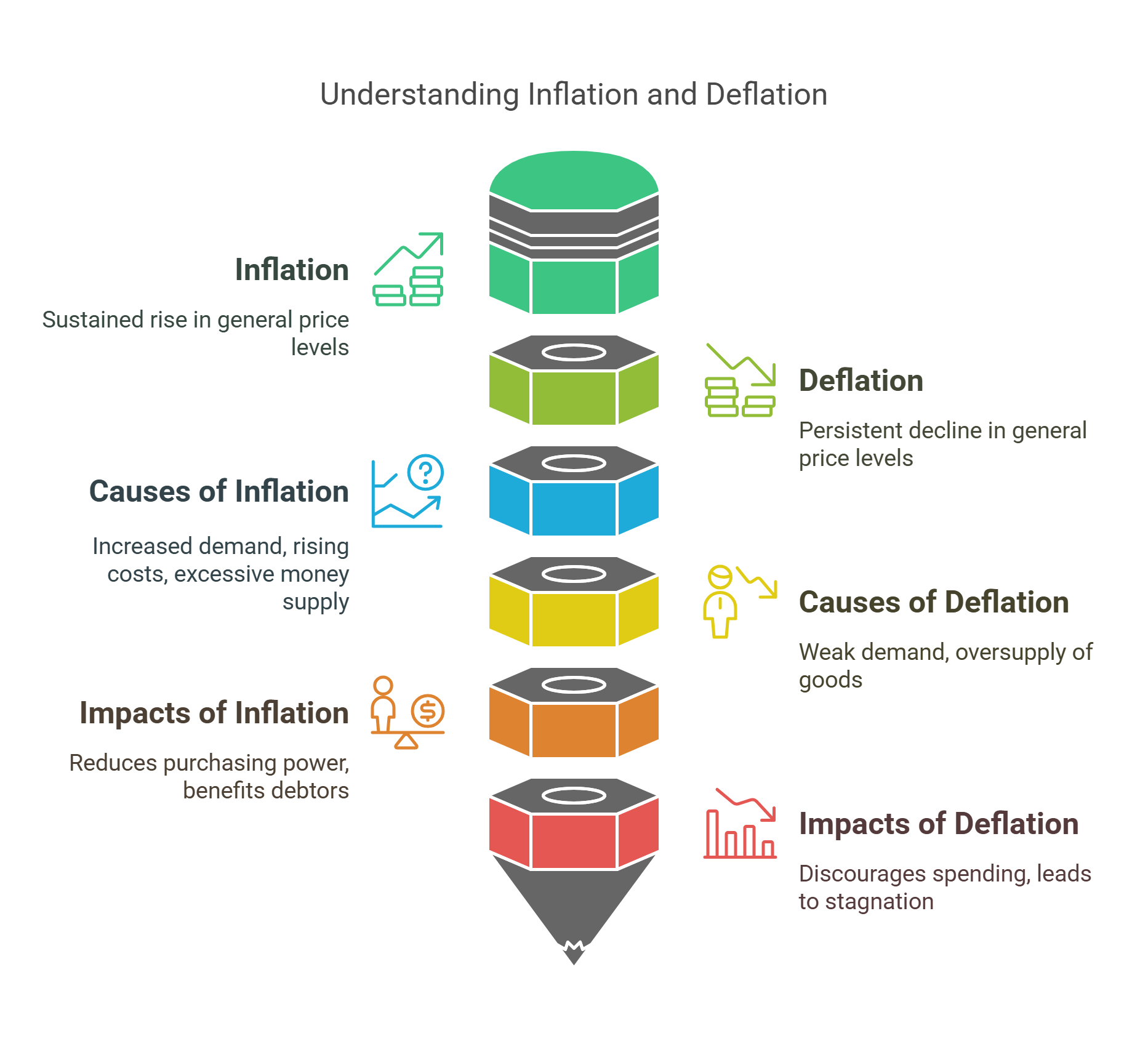

5. Inflation vs. Deflation

Detailed Explanation: Inflation and deflation represent opposing trends in price levels, each with distinct economic consequences:

- Inflation:

- Sustained rise in general price levels.

- Causes: Increased demand, rising production costs, or excessive money supply.

- Impact: Reduces purchasing power, but can benefit debtors as debt value diminishes.

- Deflation:

- Persistent decline in general price levels.

- Causes: Weak demand or oversupply of goods.

- Impact: Discourages spending, leading to economic stagnation.

Example: Hyperinflation in Germany during the 1920s led to a currency crisis, while Japan’s deflation in the 1990s caused prolonged stagnation.

Explained Simply: Inflation is like rising tides lifting all boats, while deflation is water draining out of the harbor.

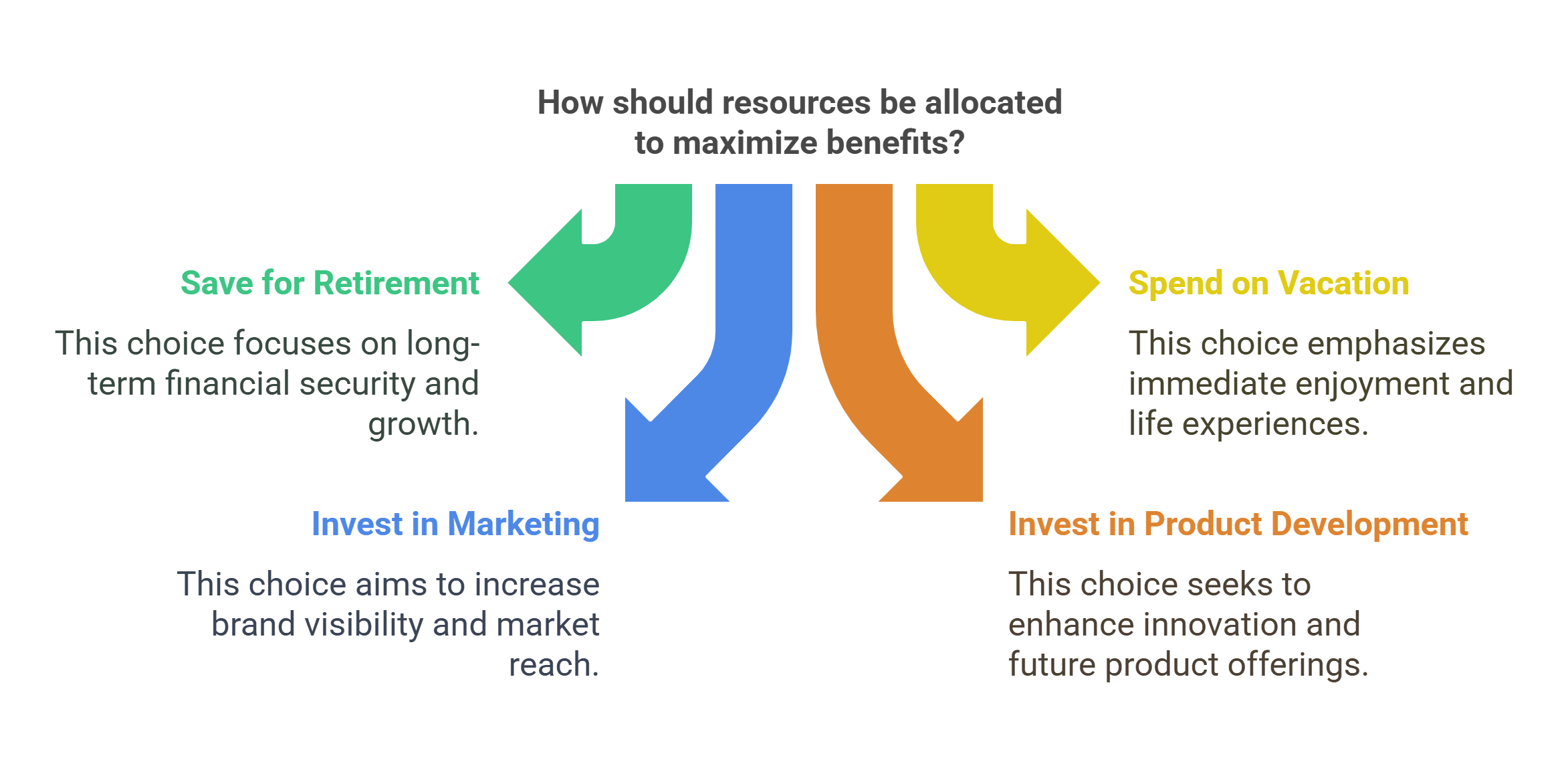

6. Opportunity Cost

Detailed Explanation: Opportunity cost is the value of the next best alternative forgone when making a choice. This concept underscores the trade-offs inherent in decision-making.

- Applications:

- Personal Decisions: Choosing between saving for retirement or spending on a vacation.

- Business Decisions: Allocating funds to marketing versus product development.

Example: If a company spends $1 million on advertising instead of research, the forgone potential innovation is the opportunity cost.

Explained Simply: Opportunity cost is like the path not taken, representing what you sacrifice for your choice.

7. Trade Deficit

Detailed Explanation: A trade deficit occurs when a country imports more goods and services than it exports.

- Impacts:

- Short-term: Can indicate strong domestic demand and access to affordable goods.

- Long-term: May lead to foreign debt or devaluation of currency.

Example: The U.S. has a persistent trade deficit due to high imports of electronics and consumer goods.

Explained Simply: A trade deficit is like spending more than you earn, requiring loans to balance the difference.

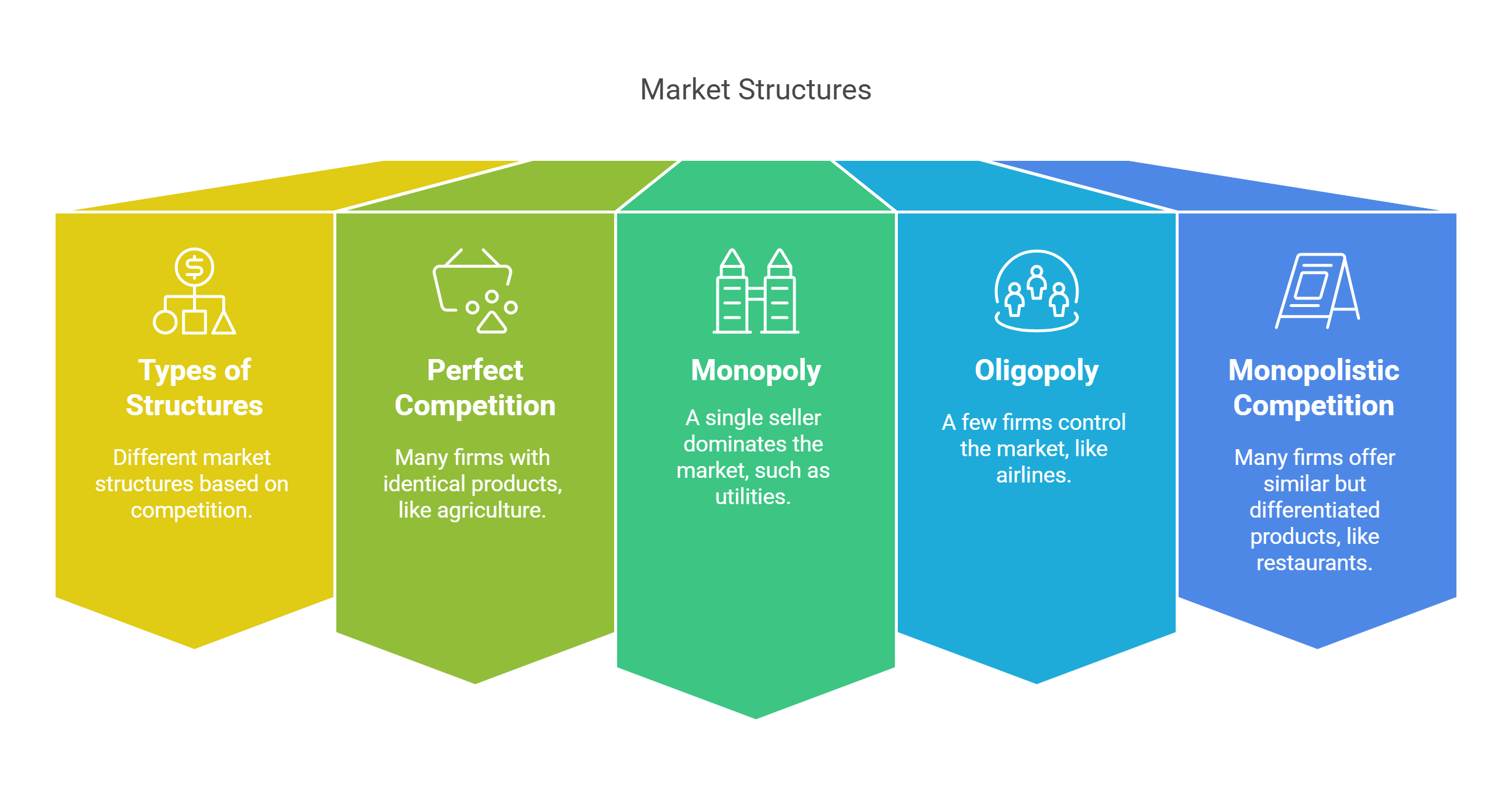

8. Market Structures

Detailed Explanation: Market structures describe how industries are organized based on competition:

- Types:

- Perfect Competition: Many firms, identical products (e.g., agriculture).

- Monopoly: Single seller dominates (e.g., utilities).

- Oligopoly: Few firms control the market (e.g., airlines).

- Monopolistic Competition: Many firms offer similar but differentiated products (e.g., restaurants).

Example: Google’s dominance in online advertising reflects monopolistic tendencies.

Explained Simply: Market structures are like games, each with unique rules for competition.

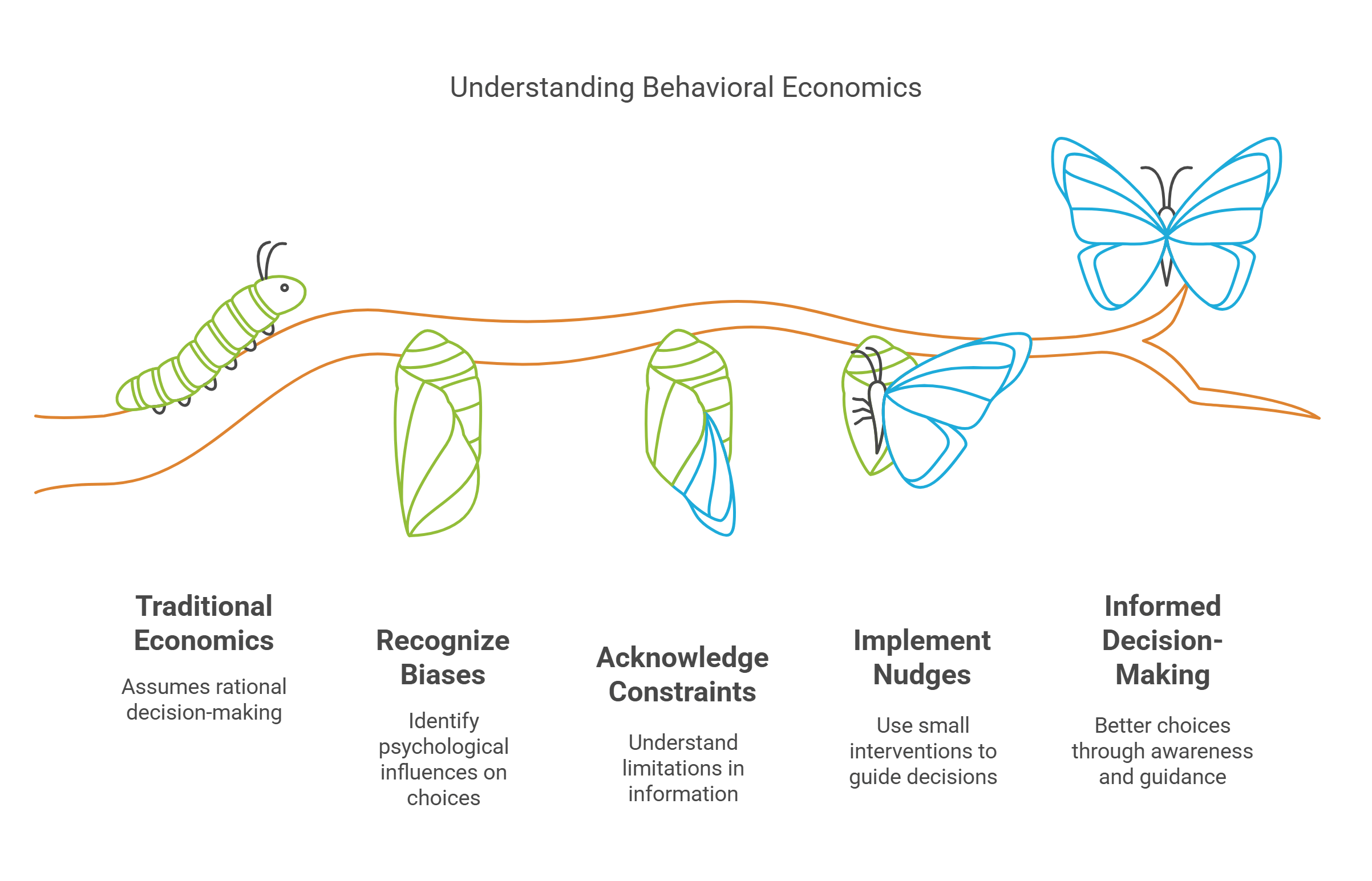

9. Behavioral Economics

Detailed Explanation: Behavioral economics examines how psychological, emotional, and cognitive factors influence decision-making, challenging traditional assumptions of rational behavior.

- Key Concepts:

- Bounded Rationality: People make decisions within limited information and constraints.

- Nudges: Small interventions guiding better choices without restricting options.

Example: Defaulting employees into retirement savings plans increases participation rates.

Explained Simply: Behavioral economics is like studying why people don’t always follow the rules of logic in their financial decisions.

10. Globalization

Detailed Explanation: Globalization is the increasing interconnectedness of economies, cultures, and populations through trade, technology, and communication.

- Pros:

- Access to diverse goods and services.

- Economic growth through trade and innovation.

- Cons:

- Increases income inequality.

- Erodes local cultures and ecosystems.

Example: The rise of multinational corporations like Apple, which operates across borders.

Explained Simply: Globalization is like a web connecting economies and cultures across the globe.

✨ Conclusion

Comparative economics highlights the complexities of economic systems, policies, and trade-offs. By understanding concepts like opportunity cost, market structures, and globalization, readers can critically analyze RC passages and current economic challenges. This field bridges theory and practice, offering tools to evaluate policies and global trends with a nuanced perspective.